Mosaic’s Phosphate Shipments Will Likely Rise

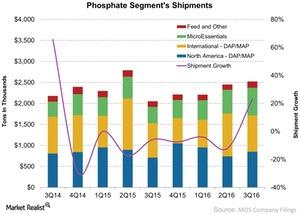

The Phosphate segment’s shipments rose 23% to ~2.5 million tons from ~2 million tons in 3Q15—compared to guidance of 2.4 million–2.7 million tons.

Nov. 2 2016, Published 10:27 a.m. ET

Phosphate shipments

In 3Q16, Mosaic (MOS) earned about half of its sales and about half of its gross margin from its Phosphate segment. Sales for fertilizer companies are a function of shipment volumes and the average realized prices for those shipments.

In this part of the series, we’ll look at how Mosaic’s phosphate shipments performed in 3Q16.

Shipments by segment

Overall, shipments for the Phosphate segment rose 23% to ~2.5 million tons from ~2 million tons in 3Q15—compared to management’s guidance of 2.4 million–2.7 million tons.

In 3Q16, North America (NANR) and International markets each accounted for ~34% Mosaic’s Phosphate segment’s shipments. Shipments to North America rose 20% to 849,000 tons from 709,000 tons in 3Q15. Similarly, International shipments in 3Q16 rose 6% to 866,000 tons from 819,000 tons in 3Q15.

Microessentials shipments grew 69% to 658,000 tons from 389,000 tons. The Microessentials segment accounted for ~26% of the Phosphate segment’s shipments. It commands a premium over standard phosphate fertilizers such as DAP (diammonium phosphate).

Microessentials share

Given the higher margins, it’s interesting to see that its share is increasing as a percentage of the total Phosphate segment’s shipments. Later in this series, we’ll discuss how the company’s gross margins fared during the quarter given that Microessentials command a premium.

Feed and other shipments also increased over the same period by as much as 12% to 148,000 tons from 132,000 tons YoY (year-over-year). Feed accounted for 6% of the Phosphate segment’s shipments.

The company also stated that it expects shipments from China to slow down due to companies shutting down outdated plants. It should also boost volumes for PotashCorp (POT), Agrium (AGU), and Israel Chemicals (ICL).

While the growth in shipments is welcome, why did the segment’s sales fall 9% YoY during the quarter? To answer this question, we’ll discuss phosphate pricing in the next part.