Crude Oil Rose, Copper and Gold Were Weaker in the Early Hours

At 5:35 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $47.91 per barrel—a rise of ~5.9%.

By Val Kensington

Nov. 20 2020, Updated 2:39 p.m. ET

Crude oil

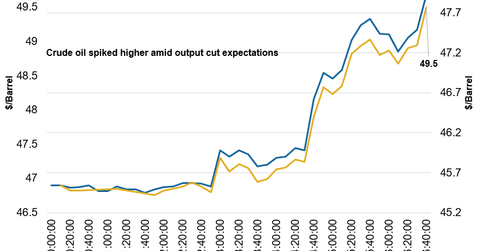

- Crude oil prices rose early on November 30 amid optimism about the successful execution of supply cuts.

- Bijan Zanganeh, Iran’s oil minister, said that he thinks that OPEC members will reach an agreement regarding the output deal.

- Prices rose in the early hours on November 30 when Noureddine Bouterfa, Algeria’s oil minister, said that he’s “99% certain” that OPEC’s meeting will be successful.

- In its previous meeting in Algeria, OPEC announced a supply cut for its members to 32.5 MMbpd–33 MMbpd (million barrels per day). The market is looking forward to producers’ meeting on November 30 in Vienna. Individual supply quotas will be declared.

- At 5:35 AM EST, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $47.91 per barrel—a rise of ~5.9%. The Brent crude futures contract for January 2017 delivery rose ~6.30% to $50.32 per barrel.

- The PowerShares Dynamic Energy Exploration & Production Portfolio (PXE) and the SPDR S&P Oil & Gas Exploration & Production (XOP) fell 1.5% and 1.9% on November 29.

Article continues below advertisement

Copper

- After pulling back on November 29, copper prices are volatile in the early hours on November 30.

- At 5:40 AM EST on November 30, the COMEX copper futures contract for March 2017 delivery fell 0.04% to $2.61 per pound.

- The rise in the oil price early on November 30 extended support to copper prices.

- Even though copper pulled back from high levels, it’s on its way to close the month with the biggest monthly gain in a decade.

- The PowerShares DB Base Metals (DBB) and the SPDR S&P Metals & Mining (XME) fell 2% and 2.1% on November 30.

Precious metals

- Gold (GLD) is weaker early on November 30 amid the firmer US dollar.

- The upbeat US GDP and Consumer Confidence data released on Tuesday dented the sentiment in the gold market.

- Increased expectations of a US interest rate hike in December is weighing on prices.

- Read How Much Could Gold React to Inflation? to learn about the gold market in relation to inflation levels.

- At 5:45 AM EST, the gold futures contract for February 2017 delivery was trading at $1,189.65 per ounce—a fall of ~0.09%.

- The platinum futures contract for January 2017 delivery was trading at $923.10 per ounce—a gain of ~0.2%.

- The silver futures contract for December delivery was trading at $16.72 per ounce—a fall of ~0.13%.

- After rising to 17-month high price levels last week, palladium continued to make fresh 2016 highs this week. At 5:47 AM EST, the palladium futures contract for March 2017 delivery was trading at $771.23 per ounce—a gain of ~0.78%.