ConocoPhillips’s Steps to Reduce Its Break-Even Price

Since 2014, ConocoPhillips (COP) has been focusing on reducing its break-even price.

Nov. 25 2016, Updated 11:04 a.m. ET

ConocoPhillips’s break-even price

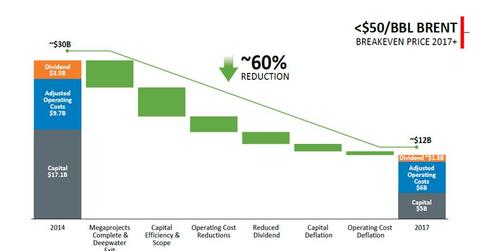

Since 2014, ConocoPhillips (COP) has been focusing on reducing its break-even price. In the last two years, ConocoPhillips’s break-even price has decreased from greater than $75 per barrel of Brent crude oil to less than $50 per barrel of Brent crude oil.

This movement represents a break-even price reduction of more than ~33% in the last two years. ConocoPhillips defines its break-even price as the Brent price that can cover costs needed to sustain production and pay its dividends.

ConocoPhillips’s break-even price reduction efforts

As shown in the above chart, ConocoPhillips (COP) successfully reduced its break-even costs by using measures such as:

- completion of megaprojects in the LNG and oil sand space

- exiting deepwater projects

- reducing capital intensity by increasing capital efficiency

- lowering operating costs

- dividend reduction

Capital deflation and operating costs deflation also contributed to lowering its break-even price reduction efforts. We’ll study ConocoPhillips’s latest operating costs guidance in Part 11. To learn more about ConocoPhillips’s capital intensity, please refer to Part 5 of this series.