Bristol-Myers Squibb Saw Improved Eliquis Sales in 3Q16

Bristol-Myers Squibb’s (BMY) cardiovascular segment consists of key drug Eliquis. This segment contributed nearly 18% of total revenues for 3Q16.

Nov. 28 2016, Updated 11:04 a.m. ET

The cardiovascular segment

Bristol-Myers Squibb’s (BMY) cardiovascular segment consists of key drug Eliquis. This segment contributed nearly 18% of total revenues for 3Q16.

Eliquis

Eliquis is an oral inhibitor that targets stroke prevention in non-valvular atrial fibrillation and the prevention and treatment of venous thromboembolism disorders. Eliquis is part of BMY’s alliance with Pfizer (PFE).

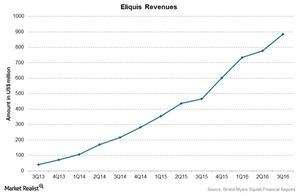

Eliquis is a new blockbuster drug from Bristol-Myers Squibb’s portfolio, and its sales rose ~90% to $884 million for 3Q16 as compared to $466 million for 3Q15. However, Eliquis is less profitable, and thus had a negative impact on the gross margins. Overall, Eliquis sales were driven by its broad label and use as well as increased prescriptions from medical practitioners. The operating expenses rose due to increased investments for drugs including Eliquis in order to support the continued growth of the drug.

Bristol-Myers Squibb is optimistic about Eliquis growth and expects Eliquis and the oncology drug Opdivo to be the growth drivers over the next five years. Eliquis competes with drugs like Xarelto from Johnson & Johnson (JNJ) and Pradaxa from Boehringer Ingelheim.

Other developments

The company’s cardiovascular research is focused on ongoing and significant unmet medical needs such as those pertaining to arrhythmia, atrial fibrillation, atherosclerosis, thrombosis, and heart failure. The company is also focused on the relationship between diabetes and heart disease. It’s trying to develop a diabetes drug with cardiovascular benefits.

Investors can consider the iShares US Healthcare ETF (IHE), which holds 6.5% of its total assets in Bristol-Myers Squibb, while it holds 3.7% in Mylan (MYL), 5.8% in Allergan (AGN), and 8.0% in Pfizer (PFE) in order to divest the risk.