How Did Bausch + Lomb’s Top Products Perform in 3Q17?

In 3Q17, Valeant Pharmaceuticals’ Bausch + Lomb’s Soflens generated revenues of $83 million, which was ~5% higher on a YoY basis and ~9% higher QoQ.

Jan. 5 2018, Updated 10:35 a.m. ET

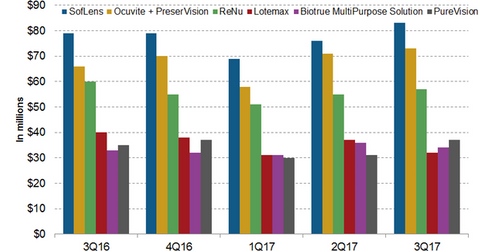

Soflens, Ocuvite + PreserVision revenue trends

In 3Q17, Valeant Pharmaceuticals’ (VRX) Bausch + Lomb’s Soflens generated revenues of $83 million, which was ~5% higher on a YoY (year-over-year) basis and ~9% higher QoQ. Soflens are daily disposable contact lenses that are now available for astigmatism.

Valeant’s disposable contact lenses compete with Johnson & Johnson’s (JNJ) Acuvue and Focus Dailies from Alcon, a subsidiary of Novartis.

In 3Q17, Ocuvite + PreserVision generated revenues of $73 million, which represents an ~11% YoY rise and a 3% QoQ rise. Bausch + Lomb’s Ocuvite and PreserVision soft gels consist of Lutein 5 mg, Zeaxanthin 1 mg, and Omega-3 250 mg. Ocuvite also includes vitamins C, vitamin E, zinc, antioxidants, and nutrients. Ocuvite and PreserVision are used for the treatment of AREDS (age-related eye disease study).

ReNu revenue trends

In 3Q17, ReNu generated revenues of $57 million, which is ~5% lower YoY and 4% higher QoQ. ReNu is a contact lens care solution.

Lotemax & BioTrue Multipurpose Solution revenue trends

In 3Q17, Lotemax and BioTrue Multipurpose solution reported revenues of $32 million and $34 million, respectively, which reflected a 20% decline and a 3% rise YoY and 14% and 16% declines, respectively, on a QoQ basis.

BioTrue ONE day and anterior disposables

In 3Q17, both BioTrue ONE day and anterior disposables reported revenues of $21 million, which reflected a 5% fall on a YoY basis and a 9% fall for both on a QoQ basis.

Artelac revenue trends

In 3Q17, Artelac generated revenues of $21 million, which reflected ~5% fall on a YoY basis and a 9% fall on a QoQ basis. Artelac is used for long-lasting relief from dry eyes.

Competitors for Valeant’s Artelac include Novartis’ (NVS) Systane Ultra and Allergan’s (AGN) Refresh Optive. In 3Q17, the Systane group of products reported revenues of $100 million.

Notably, the Guru Index ETF (GURU) invests ~0.33% of its total portfolio holdings in Valeant Pharmaceuticals.