Where the Gold-Platinum Spread Is Headed

Platinum is known for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand has been very fragile over the past few years.

Feb. 21 2017, Published 2:16 p.m. ET

Supportive European demand

Platinum is known mostly for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand for platinum has been very fragile over the past few years. Concerns surrounding the lower market forecast for sales of diesel-based vehicles have affected demand.

The increasing automotive demand from the European market concentrated on diesel is providing some support for platinum. Diesel-based vehicle demand in Europe rose almost 10.0% in January 2017.

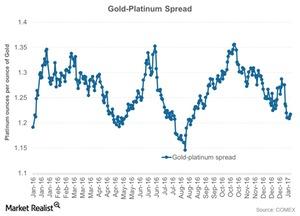

The above graph shows the performance of gold compared to platinum through the gold-platinum spread, or the gold-platinum ratio. The spread measures the number of platinum ounces it takes to buy an ounce of gold. The higher the ratio, the weaker platinum is compared to gold, because more ounces of platinum are needed to buy a single ounce of gold. The prices of gold and platinum were $1,231.70 and $1,007.80 per ounce, respectively, as of February 16, 2017.

RSI levels

The gold-platinum spread was ~1.2 on February 16, 2017. Platinum’s RSI (relative strength index) was 57. An RSI level above 70 indicates that an asset has been overbought and could fall. An RSI below 30 indicates that an asset has been oversold and could rise.

Fluctuations for these precious metals are closely reflected in funds such as the ETFS Physical Platinum (PPLT) and the SPDR Gold Shares (GLD). Precious metal mining companies that fell in the past month include Alamos Gold (AGI), First Majestic Silver (AG), Hecla Mining (HL), and New Gold (NGD).