Keytruda Leads over Opdivo in Head and Neck Cancer Treatment

CheckMate-141 Bristol-Myers Squibb’s (BMY) CheckMate-141 evaluated Opdivo for the treatment of squamous cell carcinoma of the head and neck. The study was stopped after meeting the primary endpoint in January 2016. The drug is under priority review by the FDA with an action date set for November 11, 2016. With similar approved indications, Opdivo and Merck’s (MRK) […]

Oct. 10 2016, Updated 11:04 a.m. ET

CheckMate-141

Bristol-Myers Squibb’s (BMY) CheckMate-141 evaluated Opdivo for the treatment of squamous cell carcinoma of the head and neck. The study was stopped after meeting the primary endpoint in January 2016. The drug is under priority review by the FDA with an action date set for November 11, 2016.

With similar approved indications, Opdivo and Merck’s (MRK) Keytruda are head-to-head competitors. Both drugs are checkpoint inhibitors. Keytruda is approved for use in advanced NSCLC (non-small cell lung cancer) and melanoma, while Opdivo has been approved for use in NSCLC, melanoma, and renal cell carcinoma.

Globally, head and neck cancer is the seventh most common cancer. There are 400,000 to 600,000 new cases per year. Squamous cell carcinoma constitutes 90% of head and neck cancer cases.

Opdivo and Keytruda

On August 5, 2016, Keytruda (pembrolizumab) took the lead and won FDA approval for the treatment of advanced head and neck squamous cell carcinoma. Opdivo is under review for the same indication.

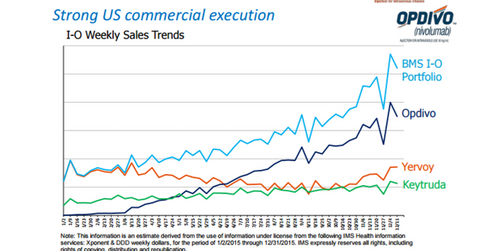

In terms of sales, Opdivo has outperformed Keytruda. While Keytruda’s revenue during the first half of 2016 totaled $563 million, Opdivo reported revenues of $1.6 billion. The difference is on account of the lung cancer market share. Keytruda is indicated for programmed death receptor-1–positive NSCLC patients, while Opdivo doesn’t have such a restriction. Along with Merck, other major companies operating in the immuno-oncology space include Roche (RHHBY), Pfizer (PFE), and AstraZeneca (AZN).

With Bristol’s continuous efforts to expand the labels for Opdivo, its revenue should grow. The rising top line might lead to a jump in BMY’s share price. If you want exposure to Bristol-Myers Squibb, you could invest in the SPDR S&P Pharmaceuticals ETF (XPH). The fund has a 4.4% exposure to BMY. Continue to the next part for an update on analyst recommendations for BMY.