Fertilizer Update: Are Market Dynamics Changing?

Producers in China primarily use coal as an input material to produce nitrogen, especially urea-based fertilizers. China is the world’s biggest urea exporter.

Nov. 1 2016, Updated 10:04 a.m. ET

Coal-based nitrogen

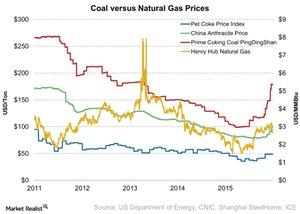

Producers in China primarily use coal as an input material to produce nitrogen, especially urea-based fertilizers. In contrast, natural gas–based fertilizer producers in North America (NANR) have been benefiting from lower-cost natural gas. China is the world’s biggest urea exporter. As a result, it’s impacted by price movements in coal.

Coal prices

Among the different categories of coal, anthracite coal is used to produce nitrogen fertilizers. For the week ending October 28, average weekly anthracite coal prices in China rose 3.7%—compared to the previous week. The prices rose to $100.9 from $97.3 per metric ton. Excluding the effects of foreign currency, anthracite coal in China rose 4.2% on the back of Chinese renminbi weakening by 48 basis points to the US dollar.

Changing market dynamics

Recently, CF Industries (CF) showed[1. Summer 2016 Investor Presentation] that about 7.6 million metric tons per year in Chinese anthracite plants closed in 2016. Chinese coal-based manufacturers have been facing price pressure. Some of them have been selling below the cost of production. It could have sparked the closures.

Remember, any rise in coal prices is positive for natural gas–based producers, especially when natural gas prices fall. Natural gas producers include CF Industries, Terra Nitrogen (TNH), and Agrium (AGU).

CVR Partners (UAN) is based in North America. It uses pet coke, a coal-like substance, to produce nitrogen fertilizers. Weekly pet coke prices for the week ending October 28 stood at $48.5—up from $41.45 the previous week.

In the next part, we’ll discuss phosphorus fertilizers such as diammonium phosphates and monoammonium phosphates.