Bunge to Partner with Oleo-Fats

Bunge (BG) has a market cap of $8.3 billion. It rose 0.80% to close at $59.23 per share on September 30, 2016.

Oct. 3 2016, Updated 2:04 p.m. ET

Price movement

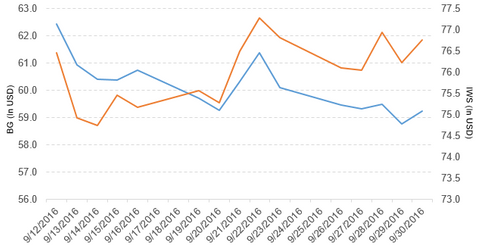

Bunge (BG) has a market cap of $8.3 billion. It rose 0.80% to close at $59.23 per share on September 30, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.5%, -7.3%, and -11.4%, respectively, on the same day.

BG is trading 3.2% below its 20-day moving average, 5.5% below its 50-day moving average, and 1.2% below its 200-day moving average.

Related ETFs and peers

The iShares Russell Mid-Cap Value (IWS) invests 0.31% of its holdings in Bunge. The ETF tracks an index of US mid-cap value stocks. The index selects from the bottom 80% of the Russell 1000, screening on value factors. The YTD price movement of IWS was 13.5% on September 30, 2016.

The iShares MSCI USA Value Factor (VLUE) invests 0.81% of its holdings in Bunge. The ETF tracks an index of large-cap and mid-cap US equities. Stocks are selected and weighted using fundamental metrics (earnings, revenue, book value, and cash earnings), aiming for exposure to undervalued stocks in each sector.

The market cap of Bunge’s competitors are as follows:

Latest news on Bunge

In a press release on September 30, 2016, Bunge reported, “Bunge Agribusiness Singapore Pte Ltd., a wholly owned subsidiary of Bunge Limited (NYSE: BG) (‘Bunge’), and Oleo-Fats, Inc., a wholly owned subsidiary of D&L Industries (PSE: DNL) (‘OFI’), have entered into distribution agreements for the foodservice, retail and food processor industries in the Asia-Pacific region.”

It added, “OFI will become Bunge’s exclusive commercial partner to import, market, sell and distribute packaged softseed oils into Philippines. Bunge will become OFI’s exclusive commercial partner to export, market, sell and distribute coconut oil under its Farm Origin brand into countries in the Asia-Pacific region.”

Performance of Bunge in 2Q16

Bunge reported 2Q16 net sales of $10.5 billion, a fall of 2.8% compared to $10.8 billion in 2Q15. Sales from its Agribusiness and Sugar & Bioenergy segments fell 2.8% and 8.2%, respectively. Sales from its Edible Oil Products and Milling Products segments rose 2.3% and 3.2%, respectively, in 2Q16 compared to 2Q15.

The company’s gross profit margin and total segment EBIT (earnings before interest and tax) rose 1.3% and 22.8%, respectively, in 2Q16 compared to 2Q15.

Its net income and EPS (earnings per share) rose to $109.0 million and $0.78, respectively, in 2Q16, compared to $72.0 million and $0.50, respectively, in 2Q15.

Bunge’s cash and cash equivalents and inventories rose 33.3% and 33.6%, respectively, in 2Q16 compared to 4Q15. Its current ratio fell to 1.3x, and its debt-to-equity ratio rose to 2.0x in 2Q16, compared to 1.5x and 1.7x, respectively, in 4Q15.

Projections

Bunge has made the following projections for 2016:

- EBIT of $10 million–$30 million for its Food & Ingredients segment, which is higher than in 2015

- EBIT of ~$30 million for its Fertilizer segment, which is higher than in 2015

- EBIT to rise $70 million–$80 million for its Sugar & Bioenergy segment

Quarterly dividend

Bunge has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

The company has also declared a quarterly cash dividend of $1.22 per share on its 4.9% cumulative convertible perpetual preference shares. The dividend will be paid on December 1, 2016, to shareholders of record on November 15, 2016.

In the next part of this series, we’ll look at McCormick & Company (MKC).