iShares MSCI USA Value Factor

Latest iShares MSCI USA Value Factor News and Updates

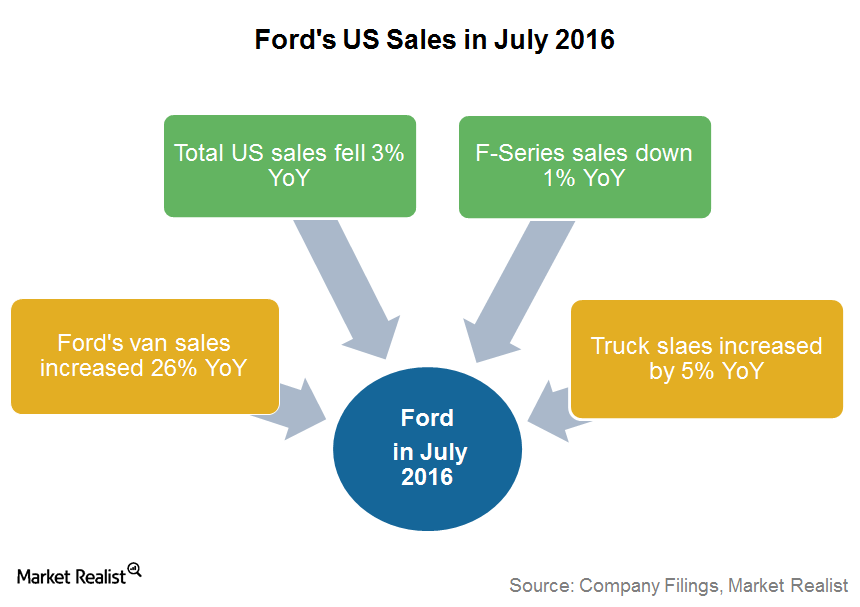

Is Ford Maintaining the Right Balance between Retail and Fleet Sales?

In July 2016, Ford’s fleet sales rose by 6% YoY to 55,321 units, whereas its retail vehicle sales fell by 6% YoY to 161,158 units.

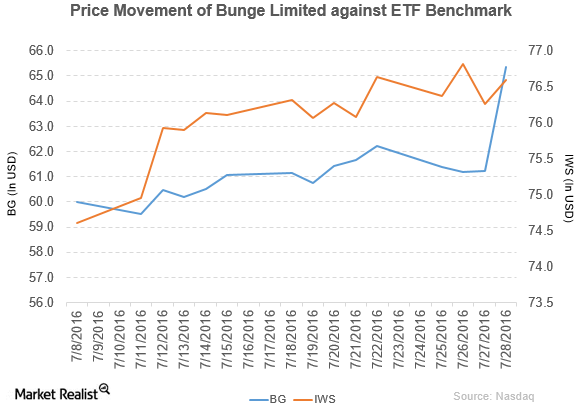

Why Bunge’s Limited Bottom Line Rose in 2Q16

Bunge Limited (BG) has a market cap of $9.1 billion. It rose by 6.7% to close at $65.35 per share on July 28, 2016.

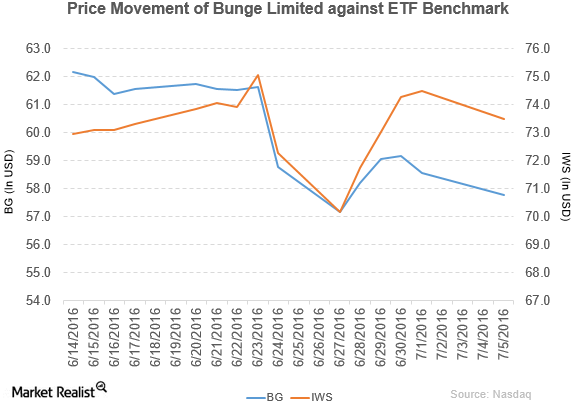

BB&T Capital Rated Bunge a ‘Buy’

Bunge reported 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in 1Q15.

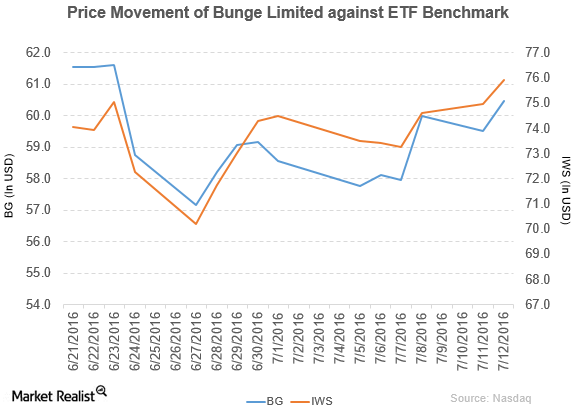

Bunge and Wilmar Form Joint Venture to Increase Market Share

Bunge Limited (BG) has a market cap of $8.2 billion. Its stock fell by 1.4% to close at $57.76 per share on July 5, 2016.