Pfizer’s Essential Health Business: What You Need to Know

In this series, we’ll discuss in detail how Pfizer plans to revive growth for the falling Essential Health business.

Sept. 9 2016, Published 4:19 p.m. ET

Essential Health business

Pfizer (PFE) operates in two segments: Innovative Health, or IH, and Essential Health, or EH. For detailed information, please read A Look at Pfizer’s Innovative Health Business.

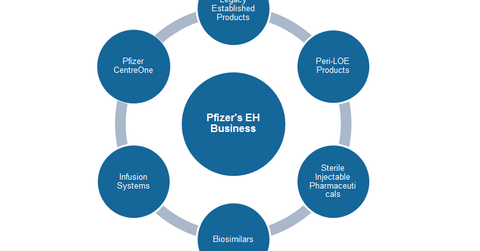

Pfizer’s EH business includes legacy brands along with branded generics, generic sterile injectable products, biosimilars, and infusion systems. In this series, we’ll discuss in detail how Pfizer plans to revive growth for the falling EH business.

How did the EH segment perform in 2Q16?

The revenues from Pfizer’s EH business rose 16% to reach $6 billion in 2Q16, up from $5.2 billion in 2Q15. The segment’s revenue from the United States stood at $2.38 billion while it fetched $3.66 billion from the international market during this period.

The revenue jump was on account of the Hospira business combination. After excluding the contribution from the legacy Hospira business, overall EH business revenues fell 3% in the second quarter of 2016. Loss of exclusivity for Lyrica and generic competition to certain Peri-LOE Products, primarily Zyvox, has caused a decline in PFE’s EH business.

EH is a comparatively low-margin business where the segment’s gross margin stood at 72.2% in 2Q16. Notably, the IH business’s gross margin during the second quarter of 2016 remained at 86%. In the next part of this series, we’ll discuss falling legacy brands in detail.

To avoid volatility and the direct risk associated with the stock—but, at the same time, enjoy exposure to inorganically growing Pfizer—you can look for options such as the Health Care Select Sector SPDR ETF (XLV). The ETF offers a 7.6% weight to Pfizer. Along with Pfizer, the fund invests its assets in Johnson & Johnson (JNJ), Merck & Co (MRK), and Amgen (AMGN).