Fossil Will Ship Smartwatches Based on Qualcomm Technologies

Fossil fell by 4.6% to close at $28.13 per share during the fifth week of August, with weekly, monthly, and YTD price movements of -4.6%, -4.8%, and -23.1%.

Sept. 6 2016, Published 1:13 p.m. ET

Price movement

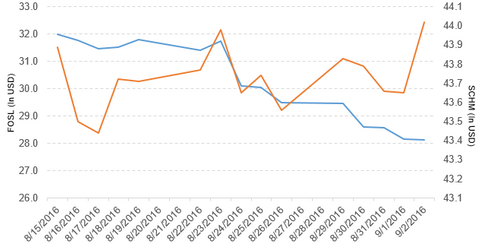

Fossil Group (FOSL) fell by 4.6% to close at $28.13 per share during the fifth week of August 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were -4.6%, -4.8%, and -23.1%, respectively, as of September 2.

FOSL is now trading 8.1% below its 20-day moving average, 6.1% below its 50-day moving average, and 20.2% below its 200-day moving average.

Related ETF and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.19% of its holdings in Fossil Group. The ETF tracks a market-cap-weighted index of mid-cap stocks in the D0w Jones US Total Stock Market Index. The YTD price movement of SCHM was 10.6% on September 2.

The market caps of Fossil Group’s competitors are as follows:

Latest news on Fossil Group

In a press release on September 1, 2016, the company stated the following: “At IFA 2016 today, Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated (QCOM), and Fossil Group (FOSL) announced today that the Qualcomm Snapdragon™ Wear 2100 processor is powering the Fossil Q Marshal and Fossil Q Wander smartwatches. With today’s announcement, Fossil becomes the first Fossil Group brand to ship smartwatches based on Qualcomm Technologies’ next generation Snapdragon Wear 2100 processor.”

Performance of Fossil in fiscal 2Q16

Fossil reported fiscal 2Q16 net sales of $685.4 million, which represents a fall of 7.4%, as compared to net sales of $740.0 million in fiscal 2Q15. Sales from its Americas, Europe, and Asia business segments fell by 10.6%, 5.3%, and 1.3%, respectively, in fiscal 2Q16 from fiscal 2Q15. The company’s gross profit margin and operating income fell by 6.2% and 78.0%, respectively, in fiscal 2Q16 from the prior year period.

Its net income and EPS (earnings per share) fell to $6.0 million and $0.12, respectively, in fiscal 2Q16, as compared to $54.6 million and $1.12, respectively, in fiscal 2Q15.

Fossil’s cash and cash equivalents fell by 19.9%, and its inventories rose by 5.8% in fiscal 2Q16 over fiscal 4Q15. Its current ratio rose to 3.2x, and its total long-term debt-to-equity ratio fell to 0.90x in fiscal 2Q16, as compared to a current ratio and the total long-term debt-to-equity ratio of 2.9x and 1.0x, respectively, in fiscal 4Q15.

Projections

Fossil has made the following projections for fiscal 3Q16:

- net sales growth: -6.0% to -2.0%

- operating margin: 2.5%–4.5%

- EPS: $0.15–$0.40

The company has made the following projections for fiscal 2016:

- net sales growth: -5.0% to -1.5%

- operating margin: 5.0%–6.5%

- EPS: $1.80–$2.65

Now we’ll discuss Newell Brands (NWL).