Guess Inc

Latest Guess Inc News and Updates

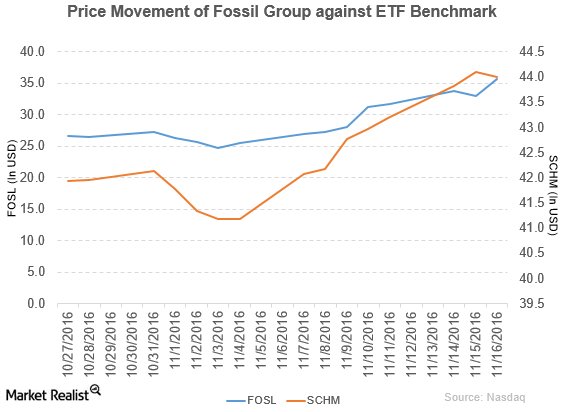

KeyBanc Capital Markets Upgrades Fossil to ‘Overweight’

Fossil Group (FOSL) has a market cap of $1.6 billion. It rose 8.4% to close at $35.70 per share on November 16, 2016.

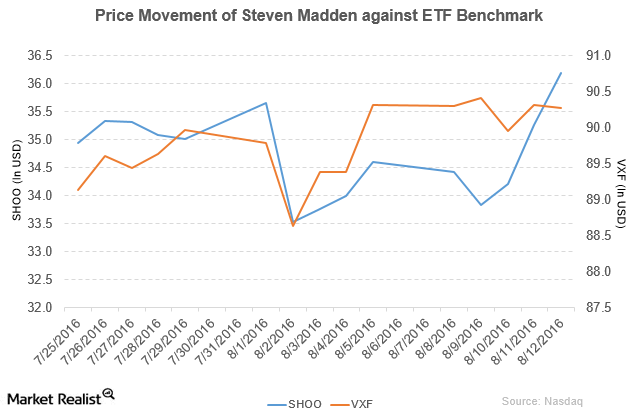

Susquehanna Rates Steve Madden as ‘Positive’

Steve Madden (SHOO) has a market cap of $2.2 billion. It rose by 2.6% to close at $36.20 per share on August 12, 2016.

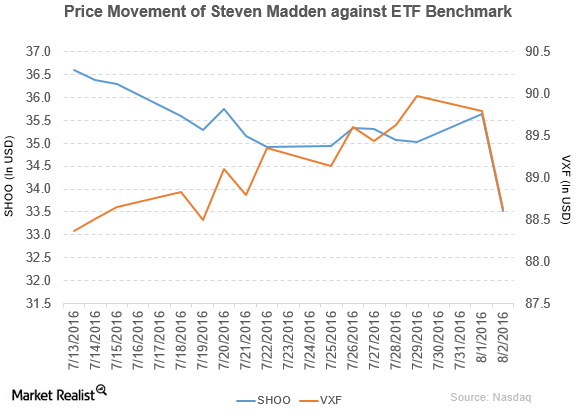

A Look at Steven Madden’s Financial Footprint in 2Q16

Steven Madden (SHOO) has a market cap of $2.1 billion. It fell by 6.0% to close at $33.52 per share on August 2, 2016.

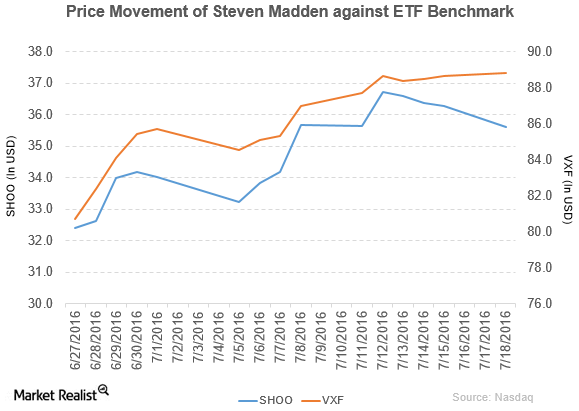

Buckingham Research Downgrades Steven Madden to ‘Neutral’

Steven Madden (SHOO) has a market cap of $2.2 billion. It fell by 1.9% to close at $35.60 per share on July 18, 2016.