Can Delek US Fully Acquire Alon USA?

Delek US Holdings will be transformed if it succeeds in the acquisition of the remaining stake in Alon USA Energy.

Sept. 28 2016, Updated 11:26 a.m. ET

Can Delek US fully acquire Alon USA?

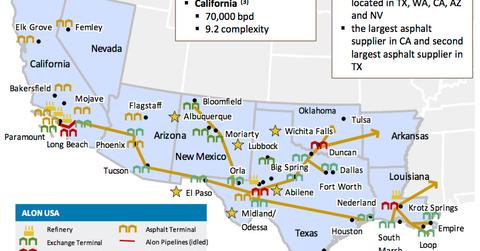

Delek US Holdings (DK), a Midland-based downstream energy company, could acquire the remaining 52% stake in Alon USA Energy (ALJ). DK currently holds a 48% stake in ALJ, which has 217 thousand barrels per day (or Mbpd) of refining capacity, a chain of retail stores, and robust logistics assets.

Even though no concrete course of action has been disclosed, the acquisition is quite likely to happen. DK recently raised funds via the sale of its MAPCO retail store chain and related assets to COPEC (or Compañía de Petróleos de Chile COPEC S.A.) for $535 million. Even though DK seeks to repay around $160 million in debt, the company still would have around $375 million additional cash on hand.

DK acquired a 48% stake in ALJ in mid-2015 for $565 million. The purchase was funded via a mixture of $200 million in cash, $145 million in debt, and 6 million DK shares. The DK-ALJ stock ratio stood at 0.45x at the time of the deal in 2015. This ratio in mid-September 2016 stood at around 0.47x.

If the acquisition gets through, DK’s refining capacity, currently at 155 Mbpd, will more than double. Plus, Alon USA’s MLP, Alon USA Partners (ALDW), will help boost DK’s logistics capabilities. DK also has an MLP with logistics assets, namely Delek Logistics Partners (DKL). Plus, the acquisition will strengthen DK’s retail asset base. Also, the operational synergies will bring about savings for the merged entity.

Series outline

Delek US Holdings will be transformed if it succeeds in the acquisition of the remaining stake in Alon USA Energy. In this series, we’ll provide an update on Delek’s operations, financials, and market performance. In the next few parts, we’ll examine analysts’ ratings, its refining margin trend, and refinery-wise margins.

Then, we’ll analyze DK’s financial position by examining the company’s leverage and cash flows. Finally, we’ll discuss DK’s valuations, short interest position, institutional ownership status, and implied volatility movements.

For exposure to refining stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~7% exposure to refining and marketing sector stocks.