How Are the Correlations of Mining Stocks Moving?

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

May 26 2017, Published 9:48 a.m. ET

Miners and precious metals

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017. Mining companies have dealt with choppy markets, but there’s been a small revival in the past week. Safe-haven bids may have also contributed to rising precious metals prices.

Precious metals mining stocks are widely expected to follow the directions of their respective precious metals. Therefore, it’s crucial to understand which stocks are closely tied to precious metals and which aren’t.

Leveraged mining funds saw a revival on May 24, 2017, despite the fall in gold. The Direxion Daily Gold Miners ETF (NUGT) and the ProShares Ultra Silver ETF (AGQ) rose despite the fall in precious metals. These two funds rose 4.2% and 1.2%, respectively, on May 24. The day-to-day movements of precious metals may not be captured by the funds, but in the long-term, they usually follow.

Correlation trends

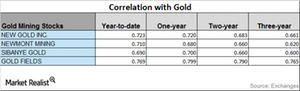

Among Goldcorp (GG), New Gold (NGD), Newmont Mining (NEM), and Agnico Eagle Mines (AEM), Goldcorp has the lowest correlation with gold, and New Gold has the highest correlation. Over the past three years, all of these miners except Agnico have seen rising correlations with gold.

Precious metals investors should study upward and downward trends because price change predictability can be impacted by precious metals prices. New Gold has a three-year correlation of ~0.66 with gold and a one-year correlation of ~0.72. A correlation of ~0.72 means that New Gold moves in the same direction as gold ~72% of the time.

It’s important to consider that the correlations of miners with gold are subject to change. Rising prices don’t necessarily mean increasing correlation.