How Merial Contributes to Sanofi’s Growth

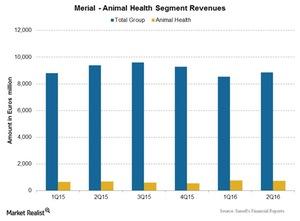

Merial, Sanofi’s (SNY) Animal Health segment, reported total revenues of 725 million euros (about $818.6 million), which is a 9.1% increase over 2Q15.

Nov. 20 2020, Updated 12:54 p.m. ET

Merial

Merial, Sanofi’s (SNY) Animal Health segment, reported total revenues of 725 million euros (about $818.6 million), which is a 9.1% increase at constant exchange rates over 2Q15 revenues.

Merial’s business is sub-categorized in two parts: Companion Animal and Production Animal. Products include parasiticides, anti-infectious drugs, other pharmaceuticals like anti-inflammatory agents and anti-ulcer agents, and vaccines.

Companion Animal

This franchise deals with drugs and vaccines for pets and domestic animals. The franchise reported revenues of 493 million euros (about $556.7 million) in 2Q16—an 8.6% increase at constant exchange rates over 2Q15.

This increase was mainly driven by NexGard, Heartgard, and Oravet sales. NexGard is a next generation flea and tick product for dogs. Oravet, a dental hygiene chews for dogs, was launched in US markets in July 2015. Notably, Bravetco, a Merck & Company (MRK) product, provides competition to the drug NexGard.

Production Animal

This franchise deals with drugs and vaccines for livestock and domestic animals raised in an agricultural setting for food and labor. The franchise reported revenues of 232 million euros (about $262 million) in 2Q16—a 10.1% increase at constant exchange rates over 2Q15.

The increase was driven by the company’s avian business in emerging markets and by its ruminant business, specifically through LongRange in the US and IvermecGold in Brazil. The avian business includes drugs for birds, while the ruminant business includes drugs for cows, cattle, and horses.

Other companies like Zoetis (ZTS), Novartis AG (NVS), Eli Lilly (LLY), Elanco, and Bayer (BAYN) have animal health divisions that compete with Merial for various products.

Remember, to divest risk, investors can always consider ETFs like the PowerShares International Dividend Achievers ETF (PID), which has 1.4% of its total assets in Sanofi.

In the next and final part, we’ll discuss Sanofi’s margins, costs, and guidance after 2Q16.