Genzyme Continued to Boost Growth for Sanofi in 2Q16

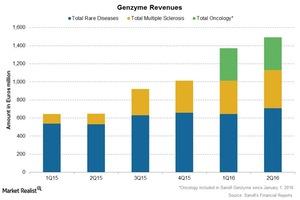

After Sanofi’s reorganization, Genzyme now includes products for multiple sclerosis, rare diseases, and oncology. Genzyme’s sales increased ~19.5% in 2Q16.

Aug. 18 2016, Updated 9:06 a.m. ET

Genzyme franchise

After the recent reorganization of Sanofi (SNY), Genzyme now includes products for multiple sclerosis, rare diseases, and oncology. Genzyme’s sales increased by ~19.5% at constant exchange rates in 2Q16 to ~1.5 billion euros (about $1.7 billion), driven by strong performances from Aubagio and Lemtrada in multiple sclerosis drugs, Fabrazyme and Cerdelga in rare diseases, and Jevtana in oncology.

Multiple sclerosis

Sanofi’s Aubagio and Lemtrada are two drugs used to treat multiple sclerosis. Multiple sclerosis drugs reported revenues of 423 million euros (about $477.6 million) in 2Q16—an increase of 67.3% over 2Q15.

Aubagio, the fastest-growing once-daily oral drug for relapsing multiple sclerosis, reported a growth of 54.5% to 306 million euros (about $345.5 million), due to increased sales in the US and Western Europe.

Lemtrada, another drug for the treatment of relapsing forms of multiple sclerosis, reported a growth of over 94% to 103 million euros (about $116.3 million). Aubagio competes with drugs like Copaxone from Teva Pharmaceuticals (TEVA), Tysabri from Biogen (BIIB), and Gilenya from Novartis AG (NVS).

Rare diseases

Rare Diseases include drugs like Cerezyme, Myozyme, and Febrazyme, which are used to treat Gaucher disease, among others. Rare Diseases’ drugs reported revenues of 707 million euros (about $798.3 million) in 2Q16, an increase of 14.2% over 2Q15, mainly driven by Myozyme, Febrazyme, Aldurazyme, and the new Cerdelga.

Oncology

Oncology’s sales declined by ~7% at 363 million euros (about $409.9 million) in 2Q16, mainly due to lower sales of Taxotere, Eloxatin, and Zaltrap, which were partially offset by Jevtana, Thymoglobulin, and Mozobil. Taxotere’s sales declined due to generic competition in Japan, while Eloxatin’s sales declined due to generic competition in Canada.

To divest risk, investors can consider ETFs like the First Trust Value Line Dividend ETF (FVD), which has 0.5% of its total assets in Sanofi, or the PowerShares International Dividend Achievers ETF (PID), which has 1.4% of its total assets in Sanofi.

Continue to the next part for a look at Sanofi’s diabetes and cardiovascular business.