Fading Risks Are Working in Favor of Emerging Markets

Low commodity (GSG) prices in the first quarter of the year impacted commodity-driven emerging markets like Russia, Brazil (EWZ), Indonesia, and Venezuela.

Aug. 16 2016, Published 1:29 p.m. ET

Headwinds have become tailwinds

The risks that seem to have abated: U.S. dollar strength fueled by monetary policy divergence in developed markets, sharply falling commodity prices and worries about China’s growth and a potential currency devaluation.

Market Realist – Economic risks to emerging markets are abating

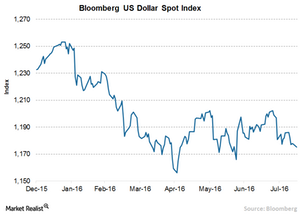

The US dollar declined against major currencies in the second quarter as weak economic indicators, like slower GDP growth and weak inflation, are expected to delay the rate hike decision. Higher interest rates normally provide stimulus to the dollar thereby making it more attractive to international investors who are in search of higher yield.

Commodity prices are rebounding

Low commodity (GSG) prices in the first quarter of the year impacted commodity-driven emerging markets like Russia, Brazil (EWZ), Indonesia, and Venezuela, among others. However, the prices of many commodities (COMT) started rebounding in 2Q16—abating the risk of more economic downside. Energy prices rose almost 30% in 2Q16. World Bank increased its forecast for many commodity prices in 2H16.

China’s economy is stabilizing

The rebalancing of China’s (FXI) (MCHI) economy from investment-led growth to a consumption-driven economy is occurring at a smoother pace than initially thought. Despite the slowdown, China’s economic growth remains higher than developed countries and many other emerging nations. According to the International Monetary Fund, China’s economy is expected to grow 6.6% in 2016—compared to just 3.1% growth for the world economy. Likewise, one year after China shocked the market by devaluing its currency by 2% against the dollar, relative calm prevails over the market as the fear of more devaluation subsided to a large extent.