Country ETFs: Double Down on Emerging Markets?

The upside reversal in emerging market equity ETFs has become one of the most remarkable investment themes in 2016. Investors don’t want to miss out.

Aug. 9 2016, Updated 9:07 a.m. ET

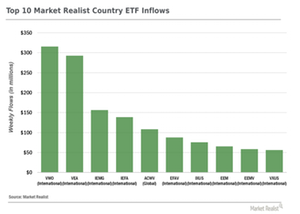

Inflows—emerging market exposure is gaining breadth

The upside reversal in emerging market equity ETFs—both in terms of performance and fund flows—has become one of the most remarkable investment themes in 2016. Last week’s market action illustrated investors’ urgency to not miss out on this trend. Examining the following chart, you can see that capital inflows into emerging market equity ETFs dominated once again. More significantly, inflows gained in breadth—four out of ten ETFs with the largest weekly inflows focus specifically on emerging markets.

Vanguard’s FTSE Emerging Markets ETF (VWO) topped the inflows list. It posted a weekly gain of ~1.2%. The iShares Core MSCI Emerging Markets ETF (IEMG) was third—it rose ~1.2%. The emerging market powerhouse, the iShares MSCI Emerging Markets ETF (EEM), and the iShares Edge MSCI Min Vol Emerging Markets ETF (EEMV) also saw inflows. Their performance was supportive as well. Note that all four emerging market ETFs broke out to fresh year-to-date highs last week as well, adding momentum to the positive sentiment in emerging markets.

From high yields to low volatility

We already discussed key drivers for the upside reversal in emerging markets equities in prior editions. The chase for higher yields found in emerging market sovereign bonds and the acceptance of elevated economic and political risks was our main focus. While these factors are relevant, a new factor should be added to the list of “emerging market positives.” Ironically enough, this factor is “low volatility.” In an investment landscape that becomes increasingly uncertain – US equities hover around all-time highs and Europe is plagued by post-Brexit pessimism – investors are trying to avoid being caught off-guard by holding investments with the potential for high volatility.

How did “high-volatility emerging market ETFs” turn into “low-volatility products?”

As emerging market equities largely outperformed on a global scale since the beginning of 2016, implied volatility has fallen sharply. This is best illustrated by pointing out the implied volatility levels in the iShares MSCI Emerging Markets ETF (EEM). The six-month implied volatility for at-the-money options in EEM as well as call and put implied volatility for 10% out-of-the-money options are trading at one-year lows. In other words, expectations for future turbulence (or large price fluctuations) are very low. Additional support for our “low-volatility argument” is provided by the increasing capital inflows into low volatility country ETFs. Last week, the iShares Edge MSCI Min Vol Global ETF (ACWV) and the iShares Edge MSCI Min Vol EAFE ETF (EFAV) made our top-ten inflow list.

Outflows—are investors giving up on Europe?

ETFs with heavy exposure to Europe dominated the capital outflows list once again last week. Notably, six out of the ten country ETFs with the largest outflows focus on Europe. This can be seen in the following chart.

The largest outflows were seen in the WisdomTree Europe Hedged Equity Fund (HEDJ), the Deutsche X-trackers MSCI EAFE Hedged Equity ETF (DBEF), and the Vanguard FTSE Europe ETF (VGK). Last week, the Bank of England announced that it won’t just cut its benchmark rate. It will also unleash another round of quantitative easing.While European equities reacted positively to this announcement—in the hope that easy monetary policy will mute the negative effects of the Brexit vote—the previously mentioned capital outflows indicate that investors used the gains in European ETFs to reduce exposure. This contrast between performance and fund flows illustrates that investors are still long-term bearish on European equities.