Bunge’s New Investment to Increase the Value of Its Business

Bunge (BG) has a market cap of $8.8 billion. It fell by 0.45% to close at $62.52 per share on August 30, 2016.

Sept. 1 2016, Updated 8:05 a.m. ET

Price movement

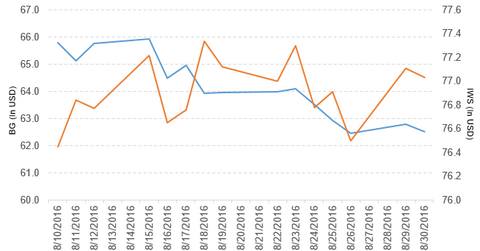

Bunge (BG) has a market cap of $8.8 billion. It fell by 0.45% to close at $62.52 per share on August 30, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.5%, -0.16%, and -6.5%, respectively, on the day.

BG is trading 2.8% below its 20-day moving average, 1.1% above its 50-day moving average, and 3.7% above its 200-day moving average.

Related ETFs and peers

The iShares Russell Mid-Cap Value ETF (IWS) invests 0.31% of its holdings in Bunge. The ETF tracks an index of US mid-cap value stocks. The index selects from the bottom 80% of the Russell 1000, screening on value factors. The YTD price movement of IWS was 13.5% on August 30.

The iShares MSCI USA Value Factor ETF (VLUE) invests 0.81% of its holdings in Bunge. The ETF tracks an index of large- and mid-cap US equities. Stocks are selected and weighted using fundamental metrics (earnings, revenue, book value, and cash earnings), with the fund aiming for exposure to undervalued stocks in each sector.

The market caps of Bunge’s competitors are as follows:

Latest news on Bunge

Bunge North America, one of Bunge’s companies, has entered into a subscription agreement to invest in Grupo Minsa to secure a controlling financial interest or management control of four mills in Mexico and two mills in the United States.

The company noted, “The facilities have a combined annual processing capacity of 700,000 metric tons and produce a broad portfolio of branded corn flours and pre-mixes for tortillas and other goods.”

It also said, “The transaction is expected to close in early 2017, subject to the authorization of the Comision Federal de Competencia Economica (Mexican Antitrust Commission), the successful delisting of the company from the Mexican Stock Exchange, and other customary closing conditions.”

According to Soren Schroder, Bunge’s CEO, “This investment enhances Bunge’s position in milling, an important contributor to our global Food & Ingredients business.” He added, “the operation is aligned with our core capabilities and increases the share of value added business in our overall portfolio.”

Performance of Bunge in 2Q16

Bunge reported 2Q16 net sales of $10.5 billion, a fall of 2.8% compared to its net sales of $10.8 billion in 2Q15. Sales from its Agribusiness and Sugar & Bioenergy segments fell by 2.8% and 8.2%, respectively. Sales from its Edible Oil Products and Milling Products segments rose by 2.3% and 3.2%, respectively, in 2Q16 compared to 2Q15.

The company’s gross profit margin and total segment EBIT (earnings before interest and tax) rose by 1.3% and 22.8%, respectively, in 2Q16 compared to 2Q15.

Its net income and EPS (earnings per share) rose to $109.0 million and $0.78, respectively, in 2Q16, compared to $72.0 million and $0.50, respectively, in 2Q15.

Bunge’s cash and cash equivalents and inventories rose by 33.3% and 33.6%, respectively, in 2Q16 compared to 4Q15. Its current ratio fell to 1.3x, and its debt-to-equity ratio rose to 2.0x in 2Q16, compared to 1.5x and 1.7x, respectively, in 4Q15.

Projections

Bunge has made the following projections for 2016:

- EBIT of $10 million–$30 million for the Food & Ingredients segment, higher than in 2015

- EBIT of ~$30 million for the Fertilizer segment, higher than in 2015

- EBIT to rise by $70 million–$80 million for the Sugar & Bioenergy segment

Quarterly dividend

Bunge has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on December 2, 2016, to shareholders of record on November 18, 2016.

The company has also declared a quarterly cash dividend of $1.22 per share on its 4.9% cumulative convertible perpetual preference shares. The dividend will be paid on December 1, 2016, to shareholders of record on November 15, 2016.

In the next part of this series, we’ll look at Snyder’s-Lance (LNCE).