Analyzing Silver Miners’ Relative Valuations

Precious metals miners with substantial exposure to silver are usually classified as silver miners.

Nov. 20 2020, Updated 3:28 p.m. ET

Silver miners

Precious metals miners with substantial exposure to silver are usually classified as silver miners. Tahoe Resources (TAHO), Coeur Mining (CDE), Hecla Mining (HL), Pan American Silver (PAAS), and First Majestic Silver (AG) make up 7.2% of the VanEck Vectors Gold Miners ETF (GDX).

Read Which Silver Miners Do Analysts Favor as 1Q17 Results Approach? for an in-depth analysis of silver miners.

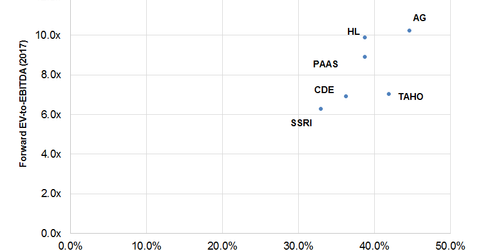

Highest multiple: First Majestic Silver

First Majestic Silver is trading at the highest EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple among its peers at 10.2x. This multiple represents a 25% premium to the group average multiple. AG has lowered its costs significantly and is on track to achieve its 2017 guidance of $11.96–$12.88 per ounce. It also has a strong balance sheet, which should support its future growth.

Moreover, there seem to be positive catalysts for the stock in 2017. These include the installation of a roasting circuit, which could add ~1.5 million ounces of silver to its annual production and could also lead to a fall in costs. These positive catalysts likely warrant the company’s premium valuation.

Other silver miners’ valuation catalysts

Hecla Mining also has a higher-than-average multiple of 10.0x. It has brought down its financial leverage significantly in 2016. Its production growth in 2016 was very impressive. The management expects to grow on record 2016 volumes going into 2017. It’s looking to start various growth projects, which should support its long-term growth.

The attractive geographical location of its assets is also a big differentiator for the company. These factors along with its large silver reserve base and low-cost operations likely warrant a premium valuation. Higher-than-expected growth could also lead to the stock’s re-rating in 2017.

Tahoe Resources is trading at a multiple of 7.0x. This discount is likely due to its high geopolitical risk compared to its peers and higher costs. Its growth profile, however, remains strong. While its stock was under pressure after its disappointing guidance in January 2017 after the release of its 1Q17 results, the stock jumped ~15%. This was mainly on the back of impressive production growth and cost improvements. Going forward, however, the costs are expected to trend higher.

Will CDE continue to trade at a discount?

Coeur Mining is trading at a forward multiple of 6.9x. This lower multiple is likely the result of its higher-than-average all-in sustaining costs and concerns regarding falling production in the medium term. Its 1Q17 results missed earnings estimates again.

As you can see in the chart above, Coeur’s EBITDA margin is the lowest among its peers. The difference is mainly the result of higher costs. In a weaker precious metals environment, this gap is likely to widen.

Investors with high-risk appetites often invest in silver miners (SIL) and leveraged ETFs such as the ProShares Ultra Silver ETF (AGQ) and the Direxion Daily Gold Miners Bull 3X ETF (NUGT).