What Do Analysts Recommend for Anadarko after Its 2Q16 Earnings?

Approximately 73% of analysts rate Anadarko a “buy,” whereas 22% rate it a “hold,” and 5% rate it a “sell.” The average broker target price is $66.50.

Aug. 2 2016, Updated 11:05 a.m. ET

Analyst recommendations for Anadarko

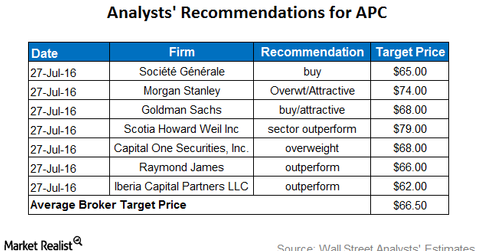

After Anadarko Petroleum’s (APC) 2Q16 earnings release, Wall Street analysts updated their target prices for the next 12 months.

Consensus rating for Anadarko Petroleum

Approximately 73% of analysts rate Anadarko a “buy,” whereas 22% rate it a “hold,” and 5% rate it a “sell.” The average broker target price of $66.50 for Anadarko implies a return of around ~24% in the next 12 months. Upstream peers Concho Resources (CXO) and Cimarex Energy (XEC) have average broker target prices of $134.54 and $130.65, respectively. These figures imply returns of 12.5%, and ~150%, respectively, in the next 12 months.

By comparison, upstream peers Concho Resources (CXO) and Cimarex Energy (XEC) have average broker target prices of $134.54 and $130.65, respectively. These figures imply returns of 12.5%, and ~150%, respectively, in the next 12 months.

The high, low, and median analyst target prices for Anadarko are $108, $42, and $65, respectively. Remember, Anadarko Petroleum is a component of the SPDR S&P North American Natural Resources ETF (NANR), which invests ~1.4% of its portfolio in APC.

Specific analyst target prices for APC

Scotia Howard Weil and Morgan Stanley (MS) gave Anadarko Petroleum one of the most optimistic target prices of $79 and $74, respectively, implying returns of around 47% and 37.5% in the next 12 months.

Goldman Sachs (GS) and Capital One Securities also gave optimistic target prices of $68 each, implying returns of around ~26% in the next 12 months.

Raymond James and Société Générale gave lower price targets of $66 and $65, respectively, implying returns of ~22% and ~21% in the next 12 months.

One of the lowest targets was given by Iberia Capital Partners, which gave Anadarko target price of $62. But this still implies a return of 15% over the next year.

For a detailed overview of the company, check out Market Realist’s Anadarko Petroleum: What’s Driving the Uptrend?