How Did Agrium’s Retail Shipments Perform in 2Q16?

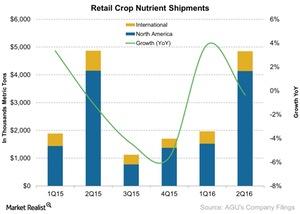

Agrium’s (AGU) Retail segment’s shipments declined by 0.03% to 4.84 million tons in 2Q16, down from 4.86 million tons in 2Q15.

Dec. 4 2020, Updated 10:53 a.m. ET

Retail shipments

In 2Q16, Agrium’s (AGU) Retail segment contributed 83% of the company’s gross profit, with North America making up the majority of the segment’s sales. Remember, for commodity companies like Agrium, Intrepid Potash (IPI), Mosaic (MOS), and Israel Chemicals (ICL), revenue is a function of shipments and prices. So let’s look now at shipments for Agrium’s Retail segment shipments in 2Q16.

Shipments decline

Agrium’s (AGU) Retail segment’s shipments declined by 0.03% to 4.84 million tons in 2Q16, down from 4.86 million tons in 2Q15. Retail segment shipments mostly come from the domestic (North American) market, which accounted for 85% of the total Retail segment’s shipment volume during the quarter, while the rest came from international markets.

Shipment volumes in North America declined to 4.13 million tons from 4.14 million tons in 2Q15. The international market saw a 3% decline in shipments YoY (year-over-year). During 2Q16, the company’s proprietary nutritional products saw a 25% growth in volumes YoY. Agrium’s Retail shipments mostly come from the domestic (North American) market, which accounted for 85% of the Retail segment’s total shipment volume in 2Q16. The rest came from international markets.

The international market saw a ~1% decline in shipment volumes YoY, falling to 715,000 tons from 722,00 tons in 2Q15. Notably, the Materials Select Sector SPDR ETF (XLB) has 1.9% of its portfolio in MOS.

Agrium has stated that it grew sales of proprietary crop nutrient products in 2Q16 as well. This is positive for the company because proprietary products command higher margins than commodity products.

Now let’s look at average realized prices for Agrium’s Retail segment.