In Retrospect: How the 2008 Crisis Affected SPY’s Valuation

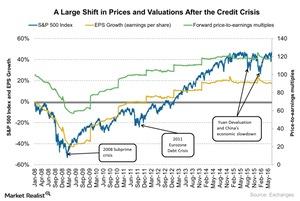

When the 2008 credit crisis affected the S&P 500 Index (SPY), we saw a large shift in valuations and the index level.

July 20 2016, Published 12:22 p.m. ET

A large shift in valuation during credit crisis

When the 2008 credit crisis affected the S&P 500 Index (SPY), we saw a large shift in valuations and the index level. The index fell by nearly 810 points, from its high of 1,486 in December 2007 to its low of 676 in March 2009.

The crisis triggered a massive fall in the index level in December 2008. The index fell by 55% during this period.

When the Market recognized the credit bubble in the United States (VOO) (VFINX) (IWM) and realized that the risk generated from this bubble could affect the whole economy, it started its downturn in mid-2008.

This kind of movement suggests that when an event occurs in the economy and the Market recognizes it, in the following trading sessions, the Market shows its reaction and establishes a pattern for future movements.

Valuations also contracted

EPS (earnings per share) growth also fell by 41% during the above-mentioned period. The valuation of the S&P 500 Index fell by 38% during the 2008 global financial crisis, while it fell by 47% during the 2002 dot-com bubble crisis.

The above events signal that the Market’s bearish sentiment ended when the index’s future valuation fell ~40%–50% from its respective peak.

After the subprime crisis

After the subprime crisis, major central banks reduced their key interest rates to near zero levels to spur growth in the economy. The rally in the S&P 500 Index was mainly driven by the Fed’s low interest rates. Earnings growth didn’t accelerate.

Again in August 2015, China’s slowing economic activity and the devaluation of the Chinese (MCHI) (ASHR) yuan hampered the movements of the S&P 500 Index. The index fell by nearly 8.2% within three days of the yuan’s devaluation in August 2015.

In the next part of this series, we’ll analyze the performance of the commodity index after the subprime crisis.