Gold Rose amid Increased Demand for Safe-Haven Assets

These economic concerns and monetary stimulus expectations have decreased the probability of an interest rate hike by the US Federal Reserve, and the chances of an interest rate hike in July dropped to zero.

Dec. 4 2020, Updated 10:53 a.m. ET

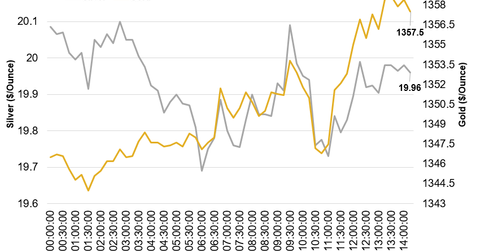

Gold and silver inch higher

Gold prices inched higher on Tuesday, July 5, amid increased concerns about economic stability. At 1:36 PM EDT, Tuesday, July 5, the COMEX gold futures contract for August delivery was trading at $1,357.35 per ounce, a gain of ~1.4%. Silver was trading at ~$19.97 per ounce, an increase of ~1.9%.

Increased demand for safe-haven assets

Britain’s vote to leave the European Union has stirred the global markets and raised fears over economic stability. On Tuesday, July 5, most of the major global exchanges declined as the Brexit fears resurfaced in the markets, boosting the demand for safe-haven assets like gold.

This pushed gold as high as $1,359.15 per ounce, and silver reached close to a two-year high. These economic concerns made the Market expect economic stimulus from major central banks around the world, including Bank of Japan, European Central Bank, People’s Bank of China, and Bank of England.

China is the largest producer and second-largest consumer of gold. In the last week, the Central Bank of China assured that it would implement a prudent monetary policy.

These economic concerns and monetary stimulus expectations have reduced the probability of an interest rate hike by the US Federal Reserve, and the chances of an interest rate hike in July dropped to zero.

At 1:54 PM EDT, Tuesday, July 5, precious metal producer Barrick Gold (ABX) gained 0.99%. Newmont Mining (NEM), Silver Wheaton (SLW), and Royal Gold (RGLD) fell by ~0.50%, ~0.56%, and ~0.60%, respectively. The SPDR Gold Trust ETF (GLD) rose by ~0.86%.

The final article in this series explains the performance of stocks related to metals and mining on July 5.