How’s Cal-Maine Trading Compared to Its Key Moving Averages?

As of July 18, 2016, Cal-Maine Foods (CALM) closed at $44.18. It traded 8.3% below its 100-day moving average and 0.7% below it 50-day moving average.

July 27 2016, Updated 9:04 a.m. ET

Moving averages

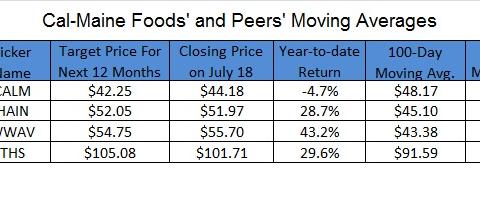

As of July 18, 2016, Cal-Maine Foods (CALM) closed at $44.18. It traded 8.3% below its 100-day moving average, 0.7% below it 50-day moving average, and 1.2% above its 20-day moving average. So far, the stock has fallen 5% in 2016. Cal-Maine Foods’ peers in the industry include Hain Celestial (HAIN), WhiteWave Foods (WWAV), and TreeHouse Foods (THS).

Peers

Hain Celestial is trading 15.2%, 5.3%, and 3.5% above its 100-day, 50-day, and 20-day moving averages. So far, it gained 28% in 2016. It closed at $51.97 on July 18. WhiteWave closed at $55.70. It traded 28.4% above its 100-day moving average, 19.1% above its 50-day moving average, and 10.9% above its 20-day moving average. So far, it has risen 43% in 2016. TreeHouse closed at $101.71. It traded 11% above its 100-day moving average, 5.2% above its 50-day moving average, and 1.0% above its 20-day moving average. So far, it rose 29% in 2016. WhiteWave Foods forms 1.4% of the iShares S&P MidCap 400 Growth ETF (IJK).

Analysts’ estimates

Analysts’ estimates indicate upsides of 0.1% for Hain Celestial and 3.2% for TreeHouse Foods from their current level on July 18 for the next 12-month period. Meanwhile, Cal-Maine and WhiteWave already beat analysts’ estimates by 4.6% and 1.7% on July 18, respectively.

Read Can Cal-Maine Foods Regain Its Momentum? to learn more about Cal-Maine Foods’ future growth priorities, as discussed in the recent Stephens Spring Investment Conference held last month.