Bunge and Wilmar Form Joint Venture to Increase Market Share

Bunge Limited (BG) has a market cap of $8.2 billion. Its stock fell by 1.4% to close at $57.76 per share on July 5, 2016.

July 10 2016, Updated 4:06 a.m. ET

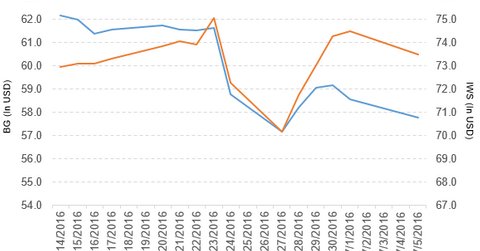

Bunge Limited’s price movement

Bunge Limited (BG) has a market cap of $8.2 billion. Its stock fell by 1.4% to close at $57.76 per share on July 5, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 1.1%, -14.8%, and -14.2%, respectively, on the same day. BG is trading 6.8% below its 20-day moving average, 7.2% below its 50-day moving average, and 7.9% below its 200-day moving average.

Related ETFs and peers

The iShares Russell Mid-Cap Value ETF (IWS) invests 0.31% of its holdings in Bunge Limited. The ETF tracks an index of US mid-cap value stocks. The index selects from the bottom 80% of the Russell 1000, screening on value factors. The YTD price movement of IWS was 7.7% on July 5.

The iShares Edge MSCI USA Value Factor ETF (VLUE) invests 0.81% of its holdings in Bunge Limited. The ETF tracks an index of large- and mid-cap US equities, selecting and weighting stocks using fundamental metrics (earnings, revenue, book value, and cash earnings) while aiming for exposure to undervalued stocks in each sector.

The market cap of Bunge’s competitors are as follows:

Bunge’s joint venture with Wilmar International

Bunge Limited and Wilmar International Limited are forming a joint venture in Vietnam to leverage both companies’ footprints in Asia by connecting Bunge’s upstream crushing capabilities to Wilmar International’s downstream oil refining and consumer products business, as well as to Green Feed’s feed milling and marketing activities.

The company also noted, “Bunge will sell 45% of its equity in its Vietnam crush operations to Wilmar, creating a three-party joint venture with Bunge and Wilmar as equal 45% shareholders and Quang Dung—a leading soybean meal distributor in Vietnam and majority owner of Green Feed, a growing Vietnamese feed milling business—retaining its existing 10% stake in the operations.”

Bunge’s performance in fiscal 1Q16

Bunge reported fiscal 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in fiscal 1Q15. Sales from its agribusiness, edible oil products, milling products, and sugar and bioenergy businesses declined 20.6%, 7.4%, 12.3%, and 11.9%, respectively. Sales from the fertilizer business increased 7.4% in fiscal 1Q16 compared to fiscal 1Q15.

Bunge’s net income and EPS (earnings per share) fell to $222.0 million and $1.54, respectively, in fiscal 1Q16, compared to $249.0 million and $1.67, respectively, in fiscal 1Q15.

Bunge’s cash and cash equivalents and inventories rose by 27.3% and 7.6%, respectively, in fiscal 1Q16 compared to fiscal 4Q15. Its current ratio and debt-to-equity ratio rose to 1.6x and 1.71x, respectively, in fiscal 1Q16, compared to 1.5x and 1.69x, respectively, in fiscal 4Q15.

Quarterly dividend

Bunge has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on September 2, 2016, to shareholders of record at the close of business on August 19, 2016.

The company has also declared a quarterly cash dividend of ~$1.22 per share on its ~4.9% cumulative perpetual preference shares. The dividend will be paid on September 1, 2016, to shareholders of record at the close of business on August 15, 2016.

In the next part of this series, we’ll look at Delphi Automotive.