BB&T Capital Rated Bunge a ‘Buy’

Bunge reported 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in 1Q15.

July 13 2016, Published 5:05 p.m. ET

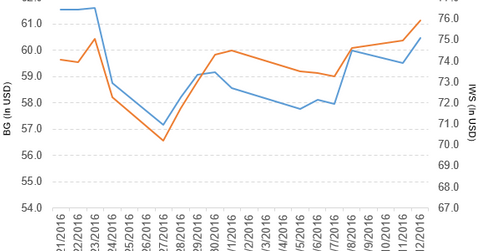

Price movement

Bunge (BG) has a market cap of $8.5 billion. It rose by 1.6% to close at $60.46 per share on July 12, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.7%, -7.6%, and -10.2%, respectively, on the same day. BG is trading 0.75% above its 20-day moving average, 2.7% below its 50-day moving average, and 3.1% below its 200-day moving average.

Related ETFs and peers

The iShares Russell Mid-Cap Value ETF (IWS) invests 0.31% of its holdings in Bunge Limited. The ETF tracks an index of US mid-cap value stocks. The index selects from the bottom 80% of the Russell 1000, screening on value factors. The YTD price movement of IWS was 11.8% on July 12.

The iShares MSCI USA Value Factor ETF (VLUE) invests 0.81% of its holdings in Bunge Limited. The ETF tracks an index of large-cap and mid-cap US equities. Stocks are selected and weighted using fundamental metrics (earnings, revenue, book value, and cash earnings).

The market caps of Bunge’s competitors are as follows:

Bunge’s rating

BB&T Capital Markets has initiated the coverage of Bunge Limited with a “buy” rating and set the stock price target at $75.0 per share.

Bunge’s performance in 1Q16

Bunge reported 1Q16 net sales of $8.9 billion, a decline of 17.5% compared to net sales of $10.8 billion in 1Q15. Sales from its agribusiness, edible oil products, milling products, and sugar and bioenergy businesses fell by 20.6%, 7.4%, 12.3%, and 11.9%, respectively. Sales from the fertilizer business rose 7.4% in 1Q16 compared to 1Q15.

Bunge’s net income and EPS (earnings per share) fell to $222.0 million and $1.54, respectively, in 1Q16, compared to $249.0 million and $1.67, respectively, in 1Q15.

Bunge’s cash and cash equivalents and inventories rose by 27.3% and 7.6%, respectively, in 1Q16 compared to 4Q15. Its current ratio and debt-to-equity ratio rose to 1.6x and 1.71x, respectively, in 1Q16, compared to 1.5x and 1.69x, respectively, in 4Q15.

Quarterly dividend

Bunge has declared a regular quarterly cash dividend of $0.42 per share on its common stock. The dividend will be paid on September 2, 2016, to shareholders of record at the close of business on August 19, 2016.

The company has also declared a quarterly cash dividend of ~$1.22 per share on its ~4.9% cumulative perpetual preference shares. The dividend will be paid on September 1, 2016, to shareholders of record at the close of business on August 15, 2016.

In the next part of this series, we’ll look at Pinnacle Foods.