What Are Analysts’ Recommendations for JetBlue Airways?

According to a Bloomberg consensus, JetBlue Airways is expected to see earnings per share (or EPS) of $0.6 in the quarter, compared to EPS of $0.58 in 3Q15.

Nov. 20 2020, Updated 5:09 p.m. ET

Earnings estimates

JetBlue Airways’ (JBLU) revenue is expected to rise 3% to $6.6 billion in 3Q16. According to a Bloomberg consensus, the company is expected to see earnings per share (or EPS) of $0.6 in the quarter, compared to EPS of $0.58 in 3Q15.

Analysts’ recommendations

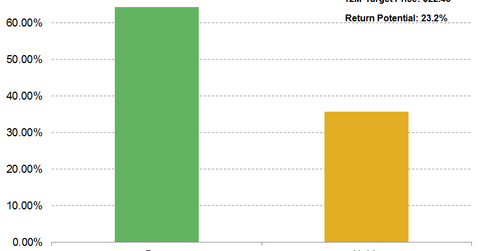

Of the 14 analysts tracking JBLU, 64.3% (nine analysts) have “buy” ratings on the stock. 61.5% of analysts had “buy” ratings on JBLU following its 2Q16 results. 35.7% (five analysts) have “hold” ratings, and no analysts have “sell” ratings on the stock.

One analyst has upgraded JBLU’s rating. All other analysts have maintained their ratings on the stock following its 2Q16 results, indicating bullishness.

Target prices

The consensus target price for JBLU is $22.45, slightly lower than its $23.59 target price following 2Q16. The stock’s current target price indicates a return potential of 23.2% from its current market price. Duane Pfennigwerth of Evercore ISI has the highest price target for JetBlue Airways at $25. Evercore has maintained a “buy” rating on the stock.

Buckingham Research Group’s Daniel McKenzie has followed this target closely, with a $24 stock price target and a “buy” rating on JBLU.

Julie Yates from Credit Suisse has reaffirmed the company’s rating of “neutral” on JBLU, with JBLU’s lowest price target of $19. Rajeev Lalwani from Morgan Stanley also has a price target of $19 on the stock.

Investors can read our pre-earnings analyses of Delta Air Lines (DAL), Alaska Air Group (ALK), American Airlines (AAL), and United Continental (UAL) to learn more about these companies’ expected earnings going forward.

JBLU forms 0.85% of the holdings of the iShares S&P Mid-Cap 400 Growth ETF (IJK).