What the World Bank Thinks Now about US Economic Growth

The World Bank expects the pace of US economic growth to be 1.9% this year—a sharp correction from the 2.7% pace the bank projected in January 2016.

June 15 2016, Published 3:15 p.m. ET

Downward revision to growth

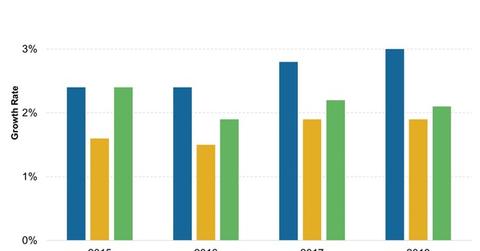

The World Bank revised its economic growth projections for the US downward in its June 2016 Global Economic Prospects report. The pace of US economic growth is expected to be 1.9% this year—a sharp correction from the 2.7% pace the bank projected in its January 2016 report. The pace is expected to pick up to 2.2% in 2017, but that’s still lower than the 2.4% pace estimated in January for 2017.

Current drivers

The World Bank stated that “softer-than-expected activity since the start of 2016 has led to downward revisions to growth projections.” The bank further pointed out that sectors of the US economy that are export-oriented or are connected with crude oil have been facing headwinds. But while low crude oil prices have hurt capital expenditure in the energy sector, the strength of the US dollar has been particularly detrimental for exporters.

The World Bank also pointed out, however, that among the positive aspects of the US economy were “above-trend gains in real disposable income,” which has come about due to strong job additions for the past several months. The rise in disposable income has kept the US economic engine chugging along with a rise in household spending.

Not too high expectations

Citing the US Federal Reserve’s downwardly revised views on the target range of the federal funds rate, the World Bank also said that external risks for the US have risen. As a result, it believes that the US may witness “a persistently low rate of potential growth” in the medium term.

Investment implications

Now all eyes are on the Fed’s June monetary policy meeting, which ends on June 15. Yields have fallen quite a bit, and even though a rate hike is not very likely, a hawkish view by the Fed will send short-term bond (SHY) (VCSH) yields surging.

However, for the longer-term, investors should focus on economic indicators like non-farm payrolls and inflation, apart from household spending, to see whether the US is in for a relatively long period of unspectacular growth. If so, not only will it delay monetary policy tightening, but also the subdued economic growth will flow over to equities (VTI) (IWV) (RSP).

Now let’s move on to what the World Bank has to say about the Eurozone.