Vanguard Short-Term Corporate Bond ETF

Latest Vanguard Short-Term Corporate Bond ETF News and Updates

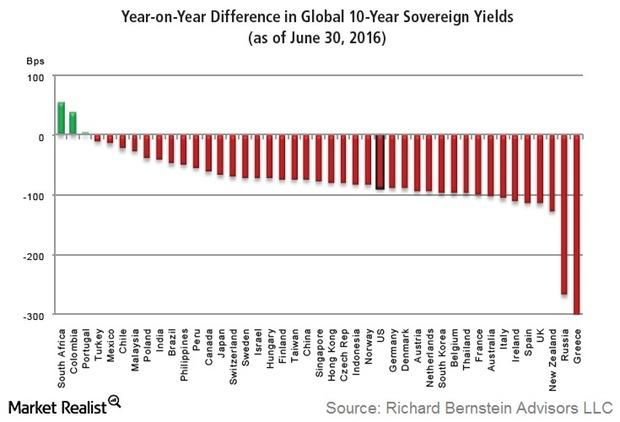

Richard Bernstein: Falling Yields Are Testimony to Risk Aversion

Bernstein asked a rhetorical question: “Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields?”

Why Richard Bernstein Sees Risk in ‘Safe’ Investments

Richard Bernstein believes that investors’ flocking to fixed-income products and shunning equities has increased their risk.

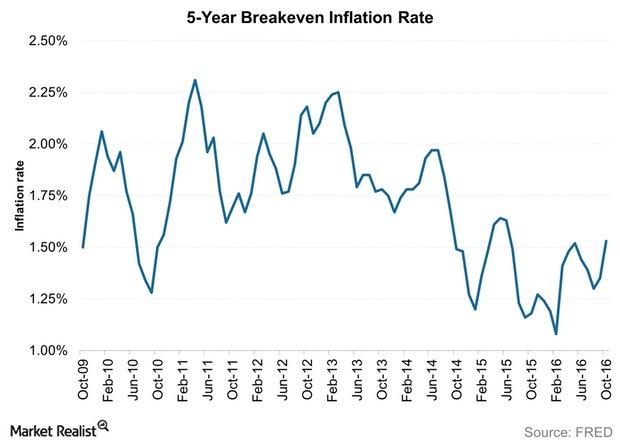

Bill Gross: Monetary Policy on Steady but Slow Path

After the release of the FOMC’s November statement, Bill Gross said that monetary policy in the United States is steadily moving toward normalization, though its pace is slow.

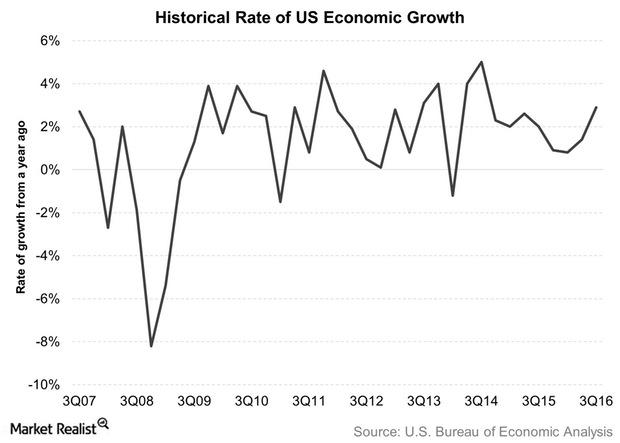

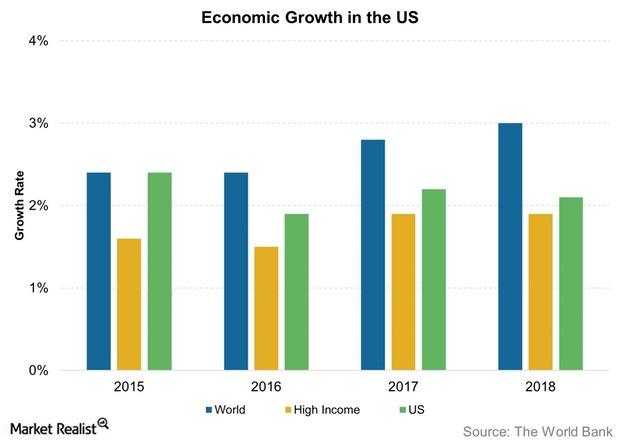

What the World Bank Thinks Now about US Economic Growth

The World Bank expects the pace of US economic growth to be 1.9% this year—a sharp correction from the 2.7% pace the bank projected in January 2016.

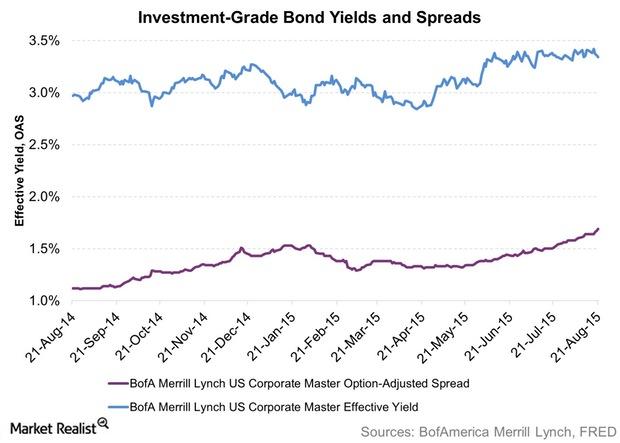

Spreads between High-Grade Bonds and Treasury Yields

If spreads widen further, high-grade bonds will become more attractive because yields and prices are inversely related. A rise in yields indicates falling prices.Financials The relationship between interest rates and credit spreads

Examining credit spreads gives investors an idea of how cheap (a wide credit spread) or expensive (a narrow credit spread) the market for a particular bond category or a particular bond is.