Morgan Stanley Upgrades GasLog

In June 2017, Morgan Stanley upgraded GasLog (GLOG) to “overweight” from “equal weight.”

Dec. 4 2020, Updated 10:50 a.m. ET

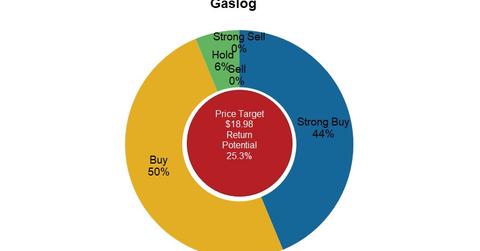

Analyst recommendations

In June 2017, Morgan Stanley upgraded GasLog (GLOG) to “overweight” from “equal weight.” Now the company has seven “strong buy” recommendations and eight “buy” recommendations. Only one analyst has given it a “hold” rating, and none of them have given it a “sell” or “strong sell” recommendation. Other LNG (liquefied natural gas) (UNG) carrier companies (GMLP)—Teekay LNG Partners (TGP), GasLog (GLOP), and Golar LNG (GLNG)—also don’t have any “sell” or “strong sell” recommendations.

Price target for GasLog

According to Reuters, the 12-month target price for GasLog (GLOG) is $18.98, compared to $15.15 on June 27, 2017. The target price implies a potential upside of 25.3%.

Revenue and earnings estimates

Analysts expect GasLog’s 2Q17 revenue to be $130.3 million, which is a 2.0% rise quarter-over-quarter and a 13.8% rise from $114.4 million in 2Q16. In 3Q17, analysts expect a further rise in revenue to $134.5 million.

Revenue for 2017 is estimated at $528.0 million, a 13.5% rise from $466.1 million in 2016. In 2018, revenue is expected to be $616.7 million.

As GasLog’s revenue is expected to rise, so is its EBITDA (earnings before interest, tax, depreciation, and amortization). Analysts have estimated that the company’s 2Q17 EBITDA will be $88.1 million compared to $89.3 million in 1Q17. The 2017 and 2018 EBITDA estimates for GasLog are $358.6 million and $424.2 million, respectively, compared to $302.3 million in 2016.