American Airlines’ Valuation: What’s Priced In?

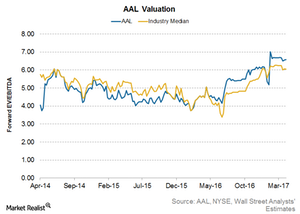

Currently, American Airlines (AAL) is valued at 6.6x its forward EV-to-EBITDA ratio (enterprise value to earnings before interest, tax, depreciation, and amortization).

April 24 2017, Updated 7:36 a.m. ET

Current valuation

Currently, American Airlines (AAL) is valued at 6.6x its forward EV-to-EBITDA ratio (enterprise value to earnings before interest, tax, depreciation, and amortization).

This valuation is higher than the company’s average post-merger valuation of 4.53x in December 2013. It’s also higher than the industry’s median valuation of 6.0x.

Peer comparison

Alaska Air Group (ALK) is trading at a similar valuation of 6.6x, followed by Southwest Airlines’ (LUV) 6.3x and Spirit Airlines’ (SAVE) 6.0x. United Continental (UAL) is trading at 5.9x, and JetBlue Airways (JBLU) is trading at 5.6x. Delta Air Lines (DAL) is trading at 5.3x.

The market is expecting DAL to see a fall of 2.9% in its EBITDA in the next year. AAL’s EBITDA is expected to rise 15%. UAL’s EBITDA is expected to fall 4%, ALK’s is expected to rise 13%, LUV’s is expected to fall 1.5%, JBLU’s is expected to fall 2.7%, SAVE’s is expected to rise 11.5%, and ALGT’s is expected to rise 0.7%.

Our analysis

AAL’s valuations have recovered recently due to a faster-than-expected recovery in its unit revenue.

In the short term, AAL’s valuations will likely be affected by its expected future debt reduction, capacity cuts, and future margin expansion, especially now that analysts are expecting airlines’ margins to have peaked.

Investors should keep an eye on the situation in the industry, as industry fundamentals also impact companies’ valuation multiples.

For example, a significant and unexpected rise in fuel prices could be a major threat to all airlines if they cannot pass the cost on to consumers. Such an event could send their valuations tumbling down. On the other hand, if fuel prices fall further, these companies’ margins could expand, and their valuation multiples could rise.

Investors can gain exposure to American Airlines by investing in the PowerShares Dynamic Large Cap Value ETF (PWV), which invests ~1.4% of its portfolio in the stock.