Latin American Markets Rise as Inflation Levels Ease in Brazil

Latin American markets were trading higher on July 9—taking cues from other emerging markets. Brazil’s inflation rate was released lower at 8.8% in June.

July 11 2016, Updated 9:08 a.m. ET

Latin American markets rise in line with peers

Latin American markets were trading higher on July 9—taking cues from other emerging markets. Brazil’s inflation rate was released lower at 8.8% in June on an annual basis—slightly below expectations and against a 9.3% rise in the previous month. On a monthly basis, consumer prices rose by 0.35% in June—compared to an increase of 0.78% in May.

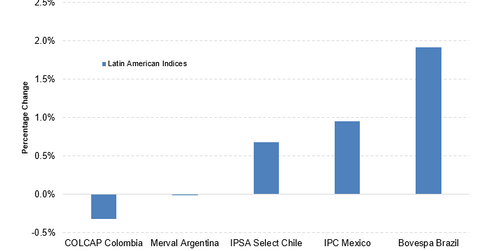

Among the Latin American indexes, the Brazilian BM&F Bovespa SA Index and the Mexican IPC Index fell by 1.9% and 0.95%, respectively, on July 8. Flat growth in global crude oil prices and other essential commodities drove the negative sentiment in the Colombian COLCAP Index—it fell by 0.32%. Colombia depends heavily on crude oil prices. The prices directly impact its export revenues. The Argentina Merval Index was trading flat, while the Chilean IPSA Select Index rose by 0.68% on July 8.

Chile’s inflation rate rises by 4.2% YoY

Chile’s inflation rate increased by 4.2% in June on an annual basis—in line with the same growth in May. On a monthly basis, consumer prices in Chile rose by 0.4% in June—compared to a 0.2% rise in the previous month. On the other hand, while consumer confidence in Mexico rose to 93.9 in June from 90.9 in the previous month, Brazil’s consumer confidence fell from 105.2 in May to 101.0 in June.