Phillips 66 Segments: A Fully Integrated Downstream Model

Phillips 66 (PSX) has segments in refining, midstream, chemicals, and marketing. In 1Q16, the refining segment contributed $86 million, or 24%, to its adjusted net income.

May 20 2016, Updated 1:08 a.m. ET

Phillips 66’s segments

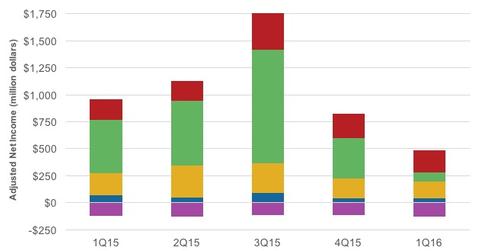

Besides its refining segment, Phillips 66 (PSX) has segments in midstream, chemicals, and marketing. Before we delve more deeply into these segments, let’s take a look at each segment’s contribution to PSX’s adjusted income.

In 1Q16, PSX’s refining segment contributed $86 million, or 24%, to its adjusted net income. The highest contributor to total adjusted net income was the marketing and specialty segment, which contributed $205 million, or 57%. The company’s chemicals segment contributed $156 million, and its midstream segment contributed $40 million to adjusted net income in 1Q16.

Of the total capex (capital expenditure) guidance of $3.9 billion for 2016, PSX plans to incur $1.2 billion in the refining segment toward sustenance and growth projects. Phillips 66 is updating its FCC (fluid catalytic cracker) at the Wood River refinery, which will increase its ability to process heavy crude oil. PSX is also modernizing the FCC at the Bayway refinery to produce higher value lighter products. The company is also carrying out a project to utilize 100% heavy crude oil and process high acid crude at the Billings refinery.

The midstream segment

Phillips 66’s midstream segment is subdivided into transportation, DCP Midstream, and NGL (natural gas liquids). Transportation includes Phillips 66 Partners (PSXP), which was formed to own, operate, grow, and acquire fee-based transportation and midstream assets. On March 31, 2016, Phillips 66 held 71% interest in PSXP, including a 2% general partner interest.

The chemicals and marketing segments

The chemicals segment manufactures and markets petrochemicals and plastic products globally. The segment includes a 50% equity investment in CPChem (Chevron Phillips Chemical). Its petrochemical project in the US Gulf Coast has approached 75% completion and is expected to start up by mid-2017. This will raise the olefins and polyolefins capacity of CPChem by one-third. In its marketing segment, Phillips 66 markets refined and specialty products such as base oils and lubricants in the United States and Europe.

The Energy Select Sector SPDR ETF (XLE) can give you a combined exposure of ~9% to Phillips 66 (PSX), Valero (VLO), Marathon Petroleum (MPC), and Tesoro (TSO).

In the next part of the series, we’ll see how Phillips 66’s leverage compare to its peers.