What Happened to Sanofi’s Consumer Healthcare and Generics Franchise in 2Q16?

Sanofi’s Consumer Healthcare segment includes Allegra, Doliprane, Nasacort, and other products. It reported a 4.3% decline in revenues to 800 million euros.

Aug. 19 2016, Updated 11:04 a.m. ET

Consumer Healthcare

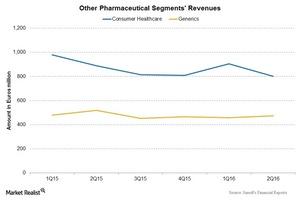

Sanofi’s (SNY) Consumer Healthcare segment includes Allegra, Doliprane, Nasacort, and other products. At constant exchange rates, the segment reported a 4.3% decline in revenues to 800 million euros (about $903.3 million) in 2Q16 as compared to 2Q15.

The negative impact of Venezuela and the divestiture of small products impacted the segment’s revenues negatively. Excluding these, revenues increased by more than 2.3%, mainly due to performance in US markets, followed by Australia, Brazil, Mexico, and Argentina.

Allegra

Allegra, an antihistamine drug, is used to treat indoor and outdoor allergies and is one of the few non-drowsy anti-allergic drugs. Allegra contributed more than 12% of the segment’s revenues at 97 million euros (about $109.5 million) in 2Q16—a decline of over 11% at constant exchange rates as compared to 2Q15.

Notably, Allegra competes with Bayer’s Claritin and Johnson & Johnson’s (JNJ) Zyrtec and Benadryl.

Nasacort

Nasacort is a nasal spray used for relief in nasal allergies. Nasacort reported a decline of 25% in its 2Q16 revenues at 23 million euros (about $26 million), mainly driven by decreased sales in US markets.

Notably, Nasacort competes with GlaxoSmithKline’s (GSK) Flonase, Novartis’s (NVS) Otrivin, and Bayer’s Afrin. Other nasal sprays include Meda Pharmaceuticals’ Dymista and Astepro and Boehringer Ingelheim’s Atrovent.

Other products

Doliprane, an analgesic, reported an 11% revenue growth to 77 million euros (about $87 million) in 2Q16 as compared to 2Q15. Enterogermina reported revenue growth of over 27% in 2Q16 at 43 million euros (about $48.6 million). Other products include Essentiale, Maalox, and Lactacyd.

Generics franchise

Sanofi’s (SNY) Generics segment contributes less toward the company’s overall revenues, and in 2Q16, it reported a revenue decline of ~2% to 474 million euros (about $535.2 million). The segment’s revenues were mainly impacted by the Venezuela effect but were partly offset by overall sales in the US and the generic version of Plavix in Japan.

Notably, Sanofi and Nichi-Iko Pharmaceuticals launched an authorized generic version of Plavix at the end of 2Q15 in Japan.

To divest risk, investors can always consider ETFs like the First Trust Value Line Dividend ETF (FVD), which has 0.5% of its total assets in Sanofi, or the PowerShares International Dividend Achievers ETF (PID), which has 1.4% of its total assets in Sanofi.

Now let’s take a look at Sanofi Pasteur.