Inside Chesapeake’s Strides toward Debt Reduction and Debt Swaps

On Thursday, May 12, Chesapeake Energy (CHK) disclosed in a regulatory filing that it plans to issue 4.1% of its outstanding equity in exchange for debt.

Aug. 18 2020, Updated 5:18 a.m. ET

CHK to swap debt for equity

On Thursday, May 12, Chesapeake Energy (CHK) disclosed in a regulatory filing that it plans to issue 4.1% of its outstanding equity in exchange for debt. The company will issue 28.1 million shares in exchange for senior notes worth $153 million. These notes include:

- $90 million 2.5% contingent convertible senior notes due 2037

- $38 million 6.5% senior notes due 2017

- $10 million 2.25% contingent convertible senior notes due 2038

- $15 million floating rate senior notes due 2019

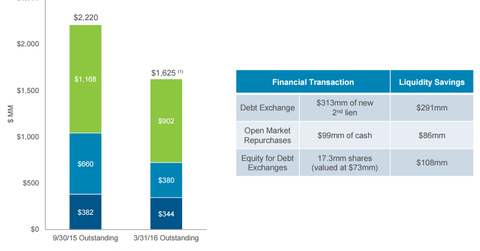

Chesapeake has been focusing on reducing its debt load. For example, over the past two quarters, it has reduced its 2017 debt maturities by ~$600 million, which is a ~27% reduction. As we can see in the image above, this was achieved through debt exchange, open market repurchases, and equity-for-debt exchanges.

CHK’s asset sales

Asset sales are another key strategy CHK is deploying to reduce its debt. In its 1Q16 earnings release, CHK noted that it had agreed to sell a portion of its acreage in the STACK play in northern Oklahoma to Newfield Exploration (NFX) for ~$470 million. So far in 2016, Chesapeake has closed or signed sales agreements amounting to approximately $950 million in net proceeds. Chesapeake Energy is planning asset sales worth $1.2 billion–$1.7 billion in 2016.

Peers Marathon Oil (MRO), Whiting Petroleum (WLL), and Anadarko Petroleum (APC) have also made asset sales one of their key strategies to bolster financial strength amid low energy prices (USO) (UNG). Combined, CHK, MRO, and APC account for 3% of the Energy Select Sector SPDR ETF (XLE).