Chinese Copper Demand Indicators: Not That Worrisome So Far

Since China (PGJ) is the largest copper consumer, it’s important for investors to keep track of Chinese copper demand indicators.

June 2 2016, Updated 11:07 a.m. ET

Chinese copper demand indicators

Since China (PGJ) is the largest copper consumer, it’s important for investors to keep track of Chinese copper demand indicators. It’s a must-know for investors in mining companies such as Freeport-McMoRan (FCX), Southern Copper (SCCO), and Rio Tinto (RIO) (TRQ). In this part of the series, we’ll look at the Chinese real estate, automobile, and manufacturing sectors.

Automobile sector

Looking at the automobile sector, the first four months of 2016 saw 7.4 million passenger cars sold in China. That’s a year-over-year (or YoY) increase of 6.6%. However, China’s official manufacturing PMI (Purchasing Managers’ Index) fell to 50.1 in April from 50.2 in the previous month.

Real estate data disappointed

- The floor area under construction by Chinese real estate development enterprises has risen by 5.8% in the first four months of the year. The rate of growth is similar to the first three months.

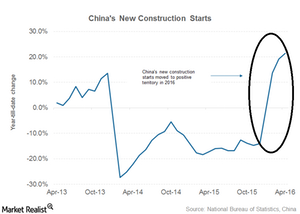

- In the first four months of 2016, building sales increased by 55.9% YoY in China. New construction starts have also risen by 21.4% YoY in the first four months after steadily declining for two years, as you can see in the graph above.

- China’s investment in fixed assets also rose by 10.5% YoY in the first four months of the year. The growth rate fell 0.2 percentage points over the first three months.

Notably, although China’s real estate and fixed investment data missed consensus estimates, they’re not all that bad. China’s copper imports have increased YoY so far in 2016. However, some of those imports have found their way into warehouses rather than going to end users. We’ll look at Chinese and global copper inventory later in this series. But before that, let’s see in the next part how US copper demand is looking this year.