PowerShares Golden Dragon China ETF

Latest PowerShares Golden Dragon China ETF News and Updates

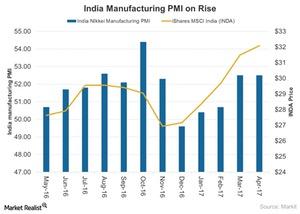

Improved Manufacturing in India, But Recovery?

The Nikkei India Manufacturing PMI for April 2017 matched its reading for the previous month.

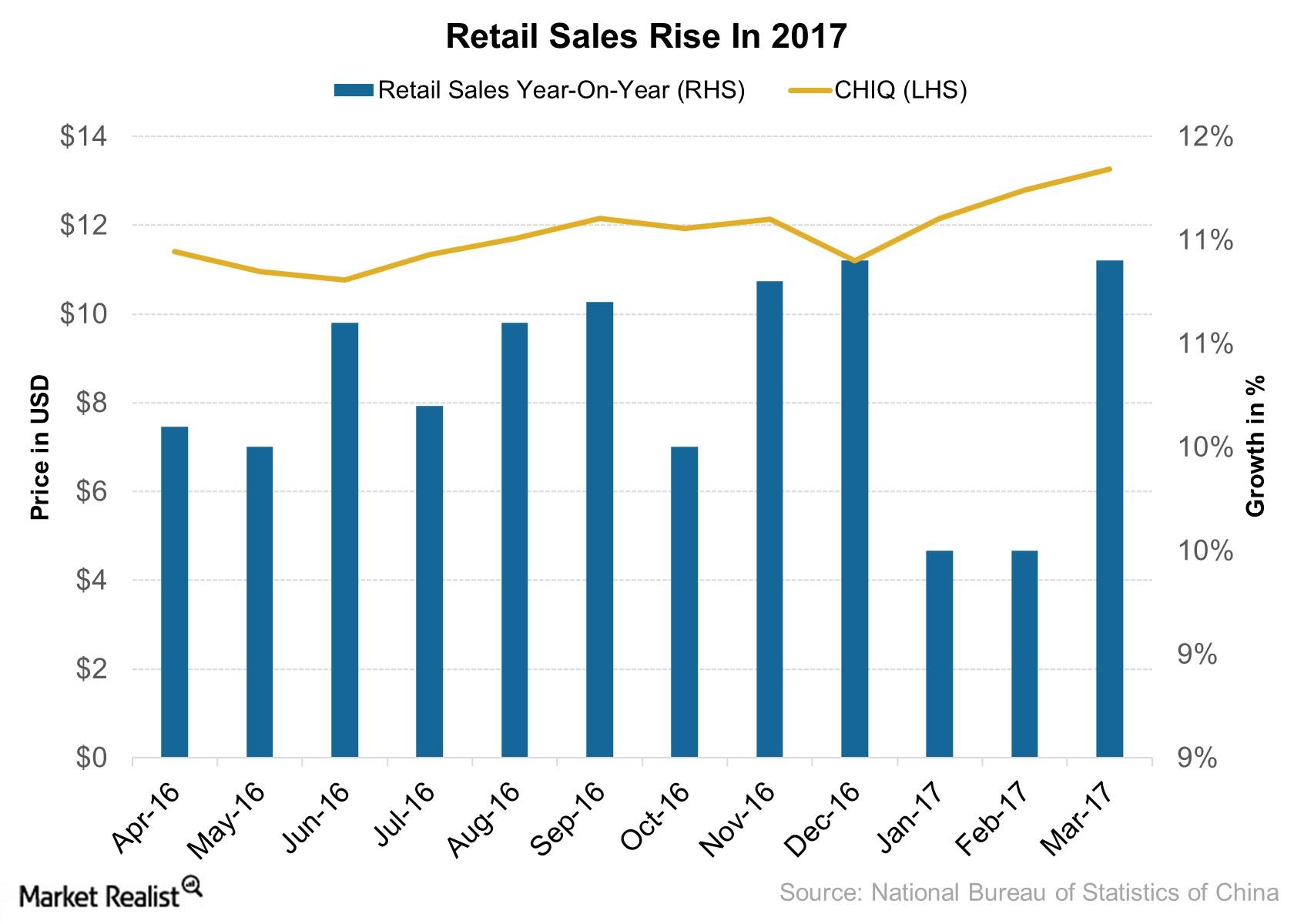

China’s Retail Sales Improved in March 2017

Retail sales of consumer goods totaled 8.5 trillion yuan (~$1.3 trillion) in 1Q17, according to the National Bureau of Statistics.

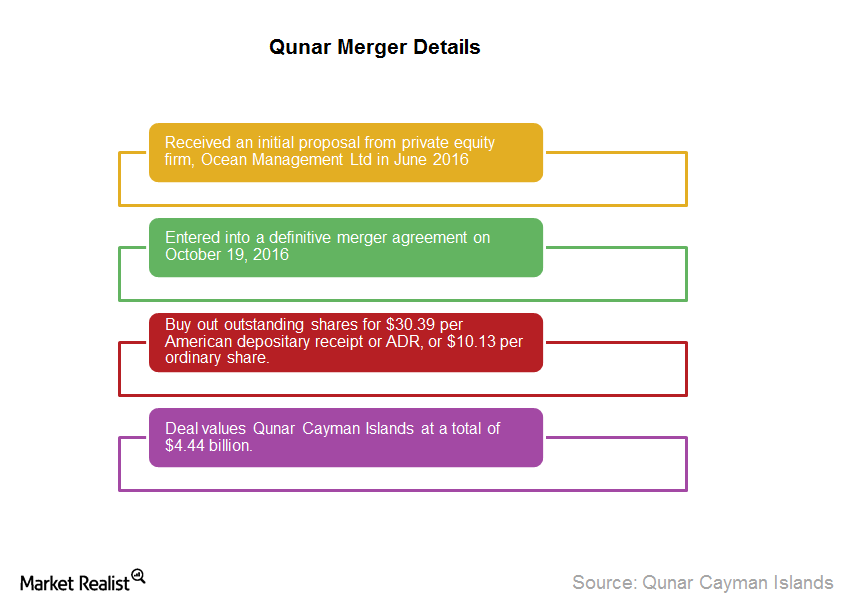

Qunar Is Going Private: How Does It Affect Investors?

In June 2016, Qunar (QUNR) received an initial proposal from private equity firm Ocean Management.

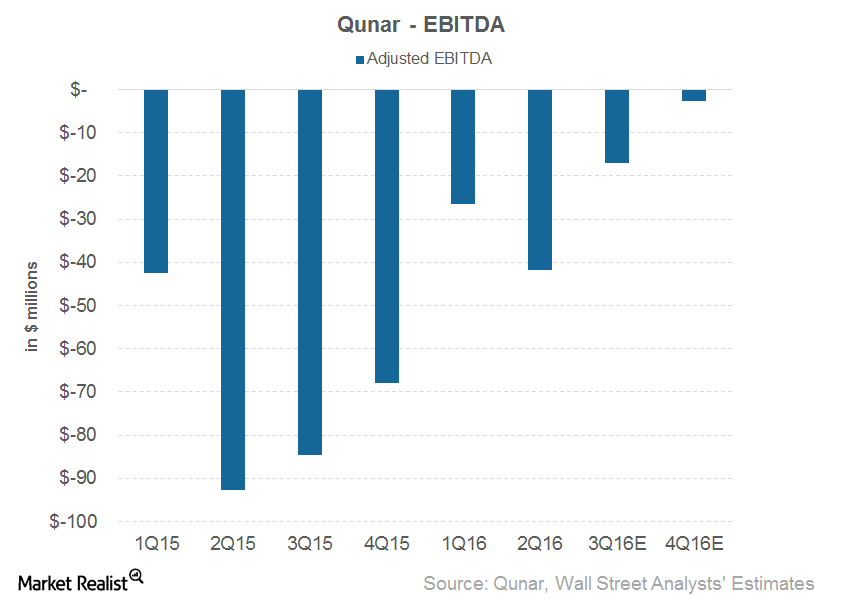

Why Isn’t Qunar Profitable Yet?

Analysts are estimating that Qunar Cayman Islands (QUNR) will incur an EBITDA loss of $17 million in 3Q16 and $3 million in 4Q16.

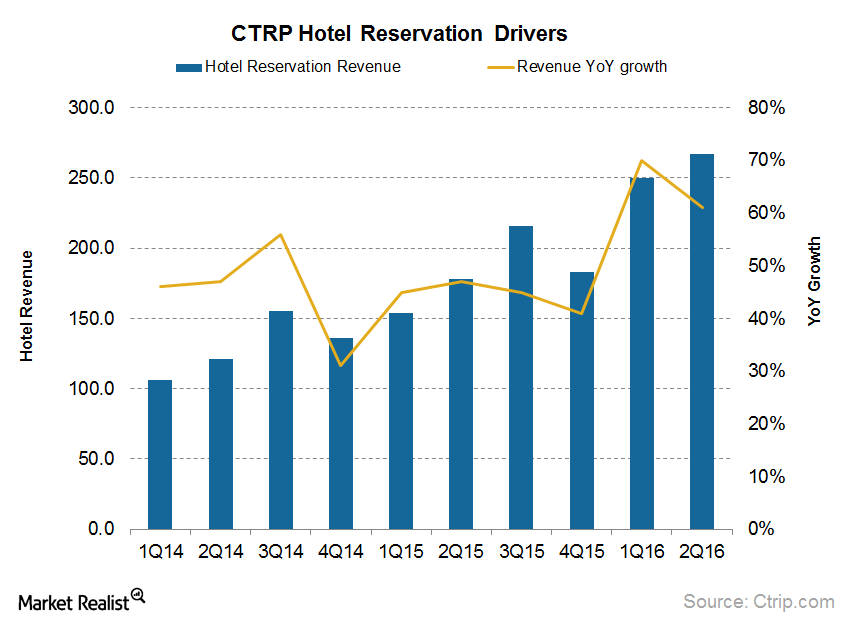

These Segments Will Contribute the Most to Ctrip’s Future Growth

At 39% in 2Q16, hotels formed a significant part of Ctrip’s revenue, much like other OTA (online travel agency) players.

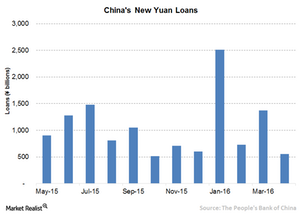

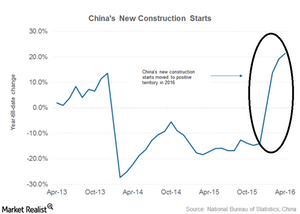

What’s Needed to Ensure Long-Term Economic Growth?

China is consistently propping up domestic demand backed by strong credit growth. The impacts of Chinese stimulus measures are starting to show results.

Chinese Copper Demand Indicators: Not That Worrisome So Far

Since China (PGJ) is the largest copper consumer, it’s important for investors to keep track of Chinese copper demand indicators.