Why Did Inflation Rates Ease for Brazil and Chile?

Brazil’s inflation rate slowed for the second straight month in March. The annual inflation rose by 9.4%—compared to 10.4% in the previous month.

April 11 2016, Published 6:27 a.m. ET

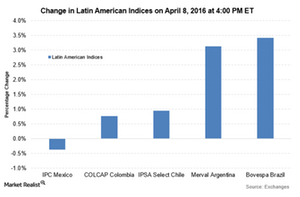

Latin American markets increase as major commodities rise

Latin American markets were taking cues from macroeconomic releases across the continent on April 8, 2016, at 4:00 PM EST. The market sentiment in Brazil was bullish as investors prepare for the impeachment vote against President Dilma Rousseff. Consumer prices fell. This lowered the inflation levels.

The Brazilian stock exchange BM&F Bovespa SA was trading higher by 3.4% during the day at 4 PM EST on April 8. The Mexican IPC index increased by 0.38%. The surge in global crude prices and other essential commodities caused the Colombian COLCAP index to trade with an upward bias of 0.76%. Of the Latin American indexes, the Argentinian Merval index and the Chilean IPSA Select index fell by 0.54% and 0.65%, respectively.

Inflation rates for Brazil and Chile

Brazil’s inflation rate slowed for the second straight month in March. The annual inflation rose by 9.4%—compared to 10.4% in the previous month. On a monthly basis, consumer prices rose by 0.43% in March—compared to 0.90% in February. A similar pattern of decreasing inflation rates was reported in Chile. Consumer prices rose by 4.5% annually in March—compared to 4.7% in February. However, on a monthly basis, inflation rose by 0.4% in March—compared to the 0.3% rise in February.

Impact on the market

Looking at important Latin America–focused ETFs on April 8, 2016, the iShares MSCI Brazil Capped ETF (EWZ) rose by 6.4% as Brazil’s inflation rate came down. The iShares MSCI Mexico Capped ETF (EWW) was trading on a higher note by 0.47% at 4:00 PM EST on April 8.

Among the Latin American countries, Mexico, Colombia, Chile, and Brazil are closely linked to commodity prices. The PowerShares DB Commodity Tracking ETF (DBC) rose by 2.4%. On a broad-based level, the iShares Latin America 40 ETF (ILF) rose by 3.8% while the iShares MSCI Emerging Markets ETF (EEM) rose by 1.7%.