What’s Happening with a Generic Version of Vyvanse?

Vyvanse, Shire’s (SHPH) key drug, earned $1.7 billion in 2015, a 21% annual growth. Analysts expect Vyvanse to add $1.9 billion and $2.1 billion to Shire’s top line in 2016 and 2017.

April 20 2016, Updated 5:04 p.m. ET

Vyvanse’s revenue projections in 2016 and 2017

Vyvanse, Shire’s (SHPG) key drug, is indicated for ADHD (attention-deficit/hyperactivity disorder) and moderate to severe BED (binge eating disorder) in adults.

The drug earned $1.7 billion in fiscal 2015, a 21% annual growth on a constant currency basis. Wall Street analysts expect the drug to further add $1.9 billion and $2.1 billion to Shire’s top line in fiscal 2016 and 2017, respectively.

Rising prescriptions of Vyvanse

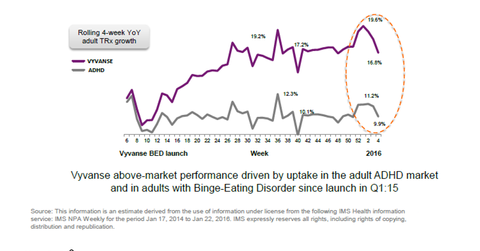

In the fourth week of January 2016, Vyvanse prescriptions increased 16.8% on a weekly basis. Overall prescription growth for the adult ADHD market was 9.9% that week. Vyvanse has consistently outpaced the industry in terms of prescription volume growth.

In fiscal 2015, Vyvanse prescriptions increased 8%. Overall, prescriptions for adult ADHD in the United States increased 6% in 2015. To further increase prescriptions of Vyvanse, Shire is following a label expansion strategy.

Is a generic version of Vyvanse on the way?

The following companies have submitted ANDAs (Abbreviated New Drug Applications) with the FDA (U.S. Food and Drug Administration) for a generic version of Vyvanse:

- Amneal Pharmaceuticals

- Roxane Laboratories

- Sandoz, a subsidiary of Novartis (NVS)

- Mylan Pharmaceuticals, a subsidiary of Mylan (MYL)

- Actavis, which is now Allergan (AGN)

However, the FDA denied all the ANDAs and determined that Shire’s patent for Vyvanse is valid until 2023. Until the patent expires, a generic version of the drug can’t be launched.

To get exposure to Shire and at the same time control excessive company-specific risks, investors can choose to invest in the VanEck Vectors Pharmaceutical ETF (PPH). Shire accounts for 5.0% of the fund’s total holdings.

Next, let’s take a look at Shire’s major valuation drivers for fiscal 2016.