Why Emerging Markets Are Rebounding

Emerging markets (IEMG) (AAXJ) are expected to grow at a healthy pace of 4% in 2016 and see even higher growth in 2017.

Nov. 20 2020, Updated 12:19 p.m. ET

BlackRock’s Richard Turnill discusses the rationale behind why we have upgraded our view on emerging market equities to overweight.

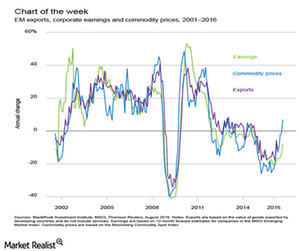

We have upgraded our view on emerging market (EM) equities to overweight, as EM growth stabilizes amid a pickup in global growth and a lower-for-longer interest rate environment. This week’s chart helps explain why.

The chart above shows that EM corporate earnings have been improving, alongside a rebound in commodity prices and a recovery in EM export growth.

Market Realist – Economic indicators favor emerging markets

Emerging markets (EEM) have started delivering healthy growth after subsiding on account of many global headwinds that negatively affected markets. Delays in interest rate hikes by the Fed, expectations of continued lower interest rates globally, strengthening of commodity prices, and stabilizing of the Chinese (FXI) economy are some of the factors driving emerging markets to a higher growth trajectory.

Uptick in commodity prices

The Bloomberg Commodity Index has risen roughly 16.6% since its yearly low recorded on January 20, while the index is up 8.2% year-to-date (or YTD). The uptick in commodity prices has benefited commodity-driven emerging markets like Russia, Brazil (EWZ), and Indonesia. Brazil recently raised its GDP forecast for 2017 to 1.7% compared to an earlier estimate of 1.2% due to improvement in various indicators. On the other hand, Russia’s recession is slowing down, and the government expects positive growth in the fourth quarter this year.

There is a strong relationship between commodity prices and the performance of emerging markets. An upswing in the oil market by over 50% since February lows has helped emerging markets (EEMV), as represented by the MSCI Emerging Market Index, rise by 30%.

Healthy growth ahead

Assuming stable commodity prices and continued economic stimulus from the developed world, emerging markets (IEMG) (AAXJ) are expected to grow at a healthy pace of 4% in 2016 and see even higher growth in 2017. That would be the first growth increase in four years. The growth was mainly driven by rising domestic consumption on the back of higher wages.