Where Does Kinder Morgan Stand Compared to Its Peers?

Kinder Morgan (KMI) is the largest company in the peer group by enterprise value (or EV).

March 28 2016, Updated 1:06 p.m. ET

KMI’s enterprise value

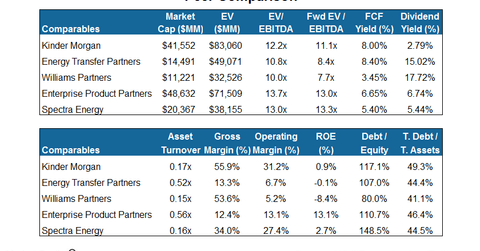

Kinder Morgan (KMI) is the largest company in the peer group by enterprise value (or EV), followed by Enterprise Product Partners (EPD). Currently, KMI has an enterprise value of $83.1 billion. Enterprise value includes the value to equity holders and debt holders. EPD has a higher market cap compared to KMI but it still has a lower enterprise value due to KMI’s huge outstanding debt. For a comparative analysis of the four largest midstream companies, please read ETE, EPD, WMB, and KMI: Are They Prepared for Tougher Times?

KMI’s operating margin

Kinder Morgan has the highest operating margin among the selected peers. The low operating margin of peers like Energy Transfer Partners (ETP) and Williams Partners (WPZ) can be attributed to their involvement in commodities acquisition and marketing businesses.

KMI’s EV/EBITDA multiple

Of the selected companies, Kinder Morgan’s forward EV/EBITDA (earnings before interest, taxes, depreciation, and amortization) multiple of 11.1x is above the group average of 10.7x. At the same time, Spectra Energy (SE) has the highest forward EV/EBITDA of 13.3x.

KMI’s dividend yield

Kinder Morgan has the lowest dividend yield among the selected peer group. KMI’s low dividend yield reflects its recent distribution cut. KMI’s peers Energy Transfer Partners (ETP) and Williams Partners (WPZ) are currently trading at high distribution yields of 17.7% and 15.0%, respectively. KMI alone constitutes 2.4% of the iShares North American Natural Resources ETF (IGE).