What Is Helping Lincoln Electrics Post an Impressive ROIC??

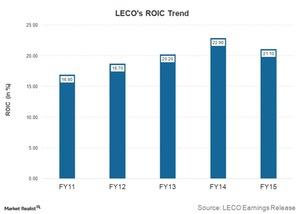

Lincoln Electric (LECO) historically has been able to generate return on invested capital (or ROIC) in the mid-teens.

April 5 2016, Updated 9:05 a.m. ET

LECO generated ROIC above 20% since 2013

Lincoln Electric (LECO) historically has been able to generate return on invested capital (or ROIC) in the mid-teens. The company has managed to keep its ROIC above 20% in the last three years, with an average ROIC of 18.4% over the past six years. The company’s ROIC compares favorably to that of the industrial machinery average (10.6%) and the industrials (XLI) sector average (9.9%).

Lincoln Electric’s dividends and buyback

In 2015, Lincoln Electric (LECO) successfully gave back $486 million to its shareholders. It returned profits to shareholders through dividends—up by 19% to $87 million—and share repurchase—up by 30% to $399 million.

Lincoln Electric has continued to generate strong returns over the past few years. Also, its debt isn’t too high. With superior operational execution, the company achieved a return on invested capital of 21.1%. It had a debt-to-equity ratio of 0.52x.

ETF investments

LECO is a part of the Robo-Stox Global Robotics and Automation Index ETF (ROBO) and accounts for 2.2% of the total holdings. Cognex Corp. (CGNX), Rockwell Automation (ROK), and ABB Ltd. (ABB) are also among the top ten holdings of the fund. They account for 2.2%, 2.1% 2.0% respectively.

LECO is also a part of the iShares S&P 1500 Index ETF (ITOT), the SPDR S&P Dividend ETF (SDY), and the SPDR S&P 500 ETF (SPY).