Rockwell Automation Inc

Latest Rockwell Automation Inc News and Updates

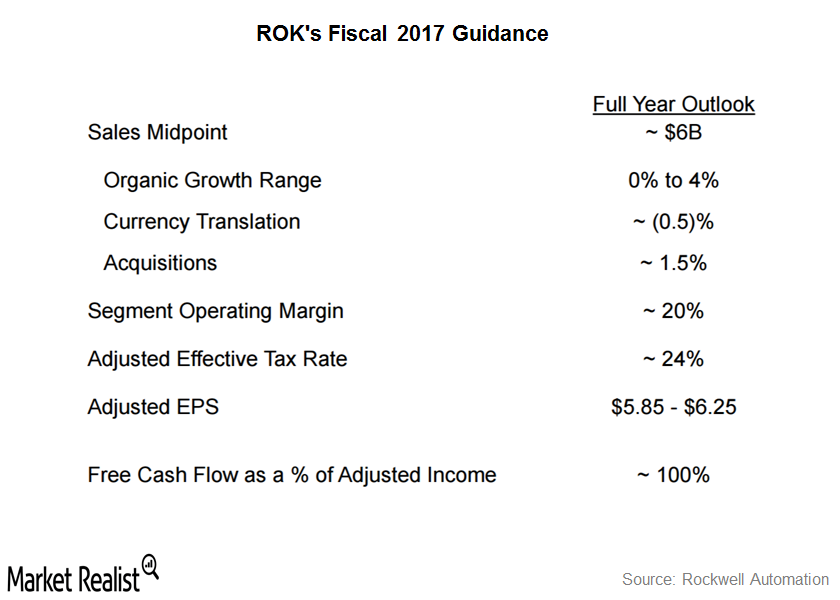

Rockwell Automation’s Fiscal 2017 Guidance: A Closer Look

ROK maintains that oil prices have recovered since early 2016 and that most of its business in the heavy industries end market is expected to stabilize.

After 3 Years, Rockwell Could See Sales Growth in Fiscal 2017

Rockwell Automation maintains that oil prices have recovered since the beginning of 2016, and most of its business in the heavy industries end market is expected to stabilize.