ABB Ltd.

Latest ABB Ltd. News and Updates

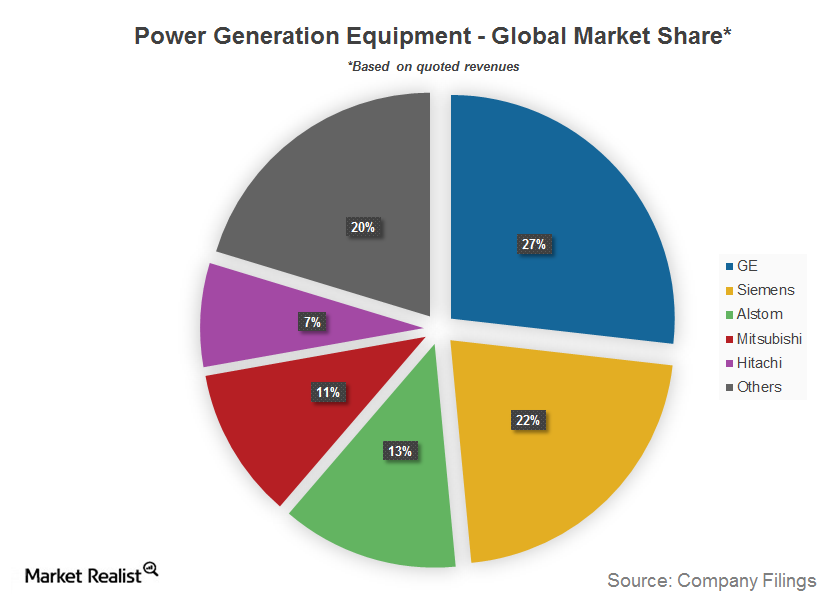

The major sub-industries of the global power equipment industry

The power generation equipment industry is made up of various sub-industries, each with a structure of its own.

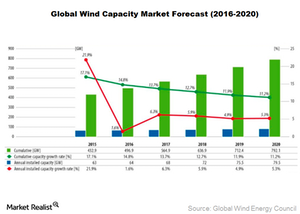

What’s the Rationale behind GE’s Proposed Acquisition?

In this article, we’ll go through the rationale behind GE’s planned acquisition of LM Wind Power. According to the GWEC, worldwide wind capacity is expected to nearly double in the next five years.

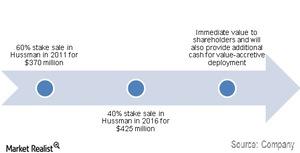

The Brass Tacks of the Ingersoll Rand-Hussmann Deal

Ingersoll Rand has agreed to sell its remaining equity interest of 40% in Hussmann to Panasonic. Panasonic will buy 100% shares according to the agreement.

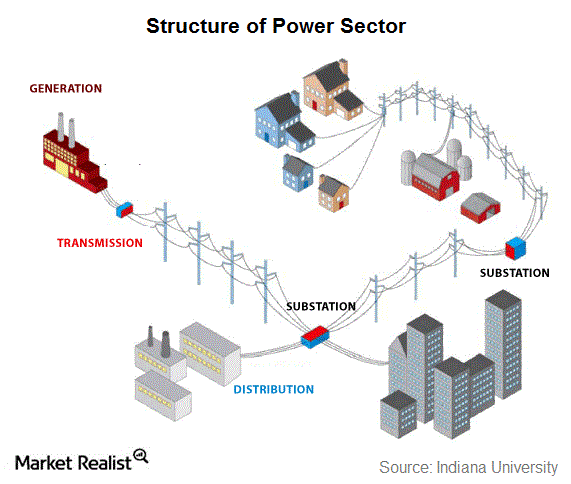

Understanding the structure of the global power sector

While the power sector differs country by country, the operational structure of the sector across the world is pretty much the same.