How Could Generic Competition Affect Copaxone’s Revenues in 2016?

Wall Street analysts have projected that Teva Pharmaceutical Industries (TEVA) will earn about $3.5 billion in revenues from Copaxone sales in 2016

March 31 2016, Updated 11:52 p.m. ET

Copaxone revenues

Wall Street analysts have projected that Teva Pharmaceutical Industries (TEVA) will earn about $3.5 billion in revenues from Copaxone sales in 2016, which will be a YoY (year-over-year) decline of about 12.2%. The drug also suffered revenue erosion in 2015, when the drug’s sales reached about $4.0 billion, which was a YoY decline of around 5.1%.

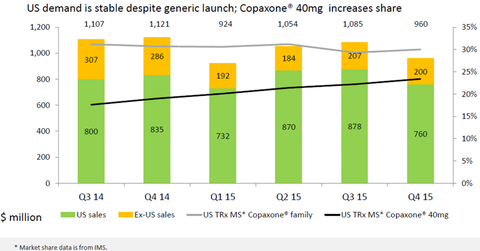

The above diagram shows that in 4Q15, the Copaxone franchise accounted for around 31.6% of the total MS (multiple sclerosis) prescriptions in the United States. While the overall demand for Copaxone has been steady, the market share of Copaxone 40 mg (milligram) has been gradually rising and made up about 25.2% of the total MS prescriptions in the United States in 4Q15. In 4Q15, the Copaxone franchise comprised about 22% of the total MS prescriptions in the world. This trend may not continue in 2016 due to increased competition from generic versions of Copaxone, such as Novartis’s (NVS) and Momenta Pharmaceuticals’ Glatopa and branded drugs such as Biogen’s (BIIB) Tecfidera. To know more about Teva’s Copaxone franchise, please refer to Copaxone, a Significant Growth Driver for Teva.

US patent expiration

Responding to Mylan’s (MYL) petitions, the United States Patent and Trademark Office has initiated inter partes review proceedings for three out of four patents belonging to Teva’s 40mg/ml (milligram/milliliter), three-times-a-week Copaxone formulation. However, Teva expects a minimal impact on its Copaxone revenues, even if Mylan succeeds in revoking these patents and launches a generic version of the formulation in the United States in January 2017.

European patents

For the Copaxone 40 mg/ml formulation in the European market, Teva Pharmaceutical holds a patent that is expected to be effective up until 2030. Already launched in 19 European countries, the therapy has managed to become a leading drug for new MS patients in Germany, Spain, the Netherlands, and Denmark. However, the Copaxone franchise witnessed lower sales in 4Q15, mainly due to 10% to 15% lower prices in the European markets. This affected per patient revenues and has put a downward pressure on revenues despite Copaxone’s strong volume growth.

The negative revenue trend for Copaxone may also affect share prices of the Vanguard FTSE All-World ex-US ETF (VEU). Teva Pharmaceutical accounts for 0.17% of VEU’s total portfolio holdings. In the next part of this series, we’ll explore Teva’s growth strategy for its generic business.