The Intense Competition in the Offshore Drilling Industry

The offshore drilling industry has a high degree of financial and operating leverage, which forces participants to engage in price competition.

Feb. 10 2016, Updated 7:05 a.m. ET

Offshore drilling competition

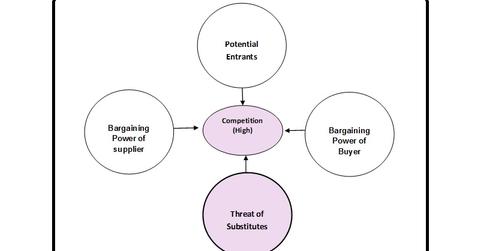

When assessing the offshore oil drilling industry’s competitiveness, we’ve already seen that the threat of potential entrants is low (see Part 11) and that the buyer and supplier power is medium (see Part 12). Now we’ll assess the offshore drilling industry’s position with respect to substitutes for offshore drilling and competition among existing companies.

Competitor rivalry

Even if the industry has experienced many consolidations in the past, it still has many participants, which serves to boost competition. Contracts for offshore drilling are obtained through competitive bidding where price, rig quality, rig location, and safety equipment are key determinants.

Notably, the industry has a high degree of financial and operating leverage, and this forces the participants to engage in price competition in order to defend their market shares and to cover their fixed costs. The industry is also characterized by standardized services, and there are high exit barriers, due to the cost and lack of alternative uses of offshore drilling rigs. This forces unprofitable companies to stay in the industry anyway, which drives down oil prices due to excess capacity and increases competition across the industry even further.

Substitutes to offshore drilling

Crude oil (DBO) can be drilled from onshore oil wells as well as from offshore wells. Offshore drilling is far more costly, complex, and time-consuming than onshore drilling, however, and the risks of accidents like oil spills are far greater in offshore drilling. If more onshore wells are discovered, it’s thus reasonable to assume that the demand for offshore drilling will decrease, as long as everything else stays constant.

This, of course, would have a negative impact on offshore drilling companies (IYE) like Diamond Offshore Drilling (DO), Noble Corporation (NE), Pacific Drilling (PACD), Seadrill (SDRL), Transocean (RIG), and Atwood Oceanics (ATW).

In the next part of this series, we’ll analyze in detail the costs, payback periods, preferences of exploration and production companies, and returns for offshore and onshore drilling.