Why Inflation Is a Double-Edged Sword for the Financial Market

Core inflation could impact the market positively as well as negatively. Higher core inflation data will depreciate the US dollar (UUP).

Feb. 22 2016, Published 1:39 p.m. ET

Inflation’s impact on the financial market

Core inflation could impact the market positively as well as negatively. Higher core inflation data will depreciate the US dollar (UUP). A weaker US dollar could boost commodity prices. It could also impact the export competitiveness of the Chinese economy (FXI).

If the Chinese yuan strengthens because of a weaker US dollar, the result could be more turmoil to equity investments. As China by no means wants its currency to appreciate, the currency war could be intensified.

The impact, however, would not be limited to China. It could spread to Japan (EWJ), India (INDY), South Korea, and other goods and services–exporting economies. For the Middle East, Brazil, and Russia, a weakening US dollar could boost revenues from crude oil exports. Gazprom Pao (OGZPY) and Lukoil (LUKOY) are Russian ADRs (American depositary receipts).

Petrobras (PBR), which represents Brazilian ADRs in the oil and gas segment, will also benefit from a weaker US dollar.

The other side of positive inflation data

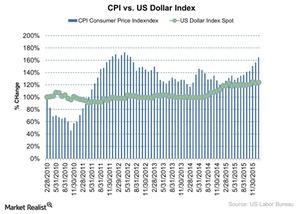

The other side of core inflation may be a rise in the interest rate. This could strengthen the US dollar by generating a negative ripple for commodity prices. The effect would be the opposite of what has been discussed, as commodity exporting countries would be negatively affected, whereas finished goods and services–exporting economies would be positively impacted. The chart above shows the relation of the US core CPI with the US dollar index.

In the next part, we’ll analyze the performance of the consumer staples industry (XLP) and how Walmart’s (WMT) full-year revenue cuts affected investors’ sentiments.