Why SunPower Reported Lower 3Q17 Revenues

SunPower (SPWR) reports its revenue under the power plant, residential, and commercial segments. The latter two segments are together called the distributed generation segments.

Nov. 10 2017, Updated 4:15 p.m. ET

Segmental revenue

SunPower (SPWR) reports its revenue under the power plant, residential, and commercial segments. The latter two segments are together called the distributed generation segments. The power plant segment includes project developments, EPC (engineering, procurement, and construction) services, as well as O&M (operations and maintenance) services.

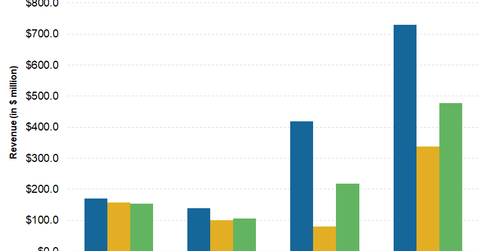

For 3Q17, revenue from the power plant segment came in at $217.9 million compared to $419.1 million in 3Q16. Revenue from the power plant segment fell due to a decline in large-scale power projects and development of global power plants. The commercial segment reported revenue of $106.0 million, compared to $139.9 million in 3Q16. Revenue from the residential segment came in at $153.2 million, compared to $170.3 million in 3Q16.

SunPower’s overall revenue

The company’s total revenue for 3Q17 came in at $477.2 million, a drastic 35% fall from $729.3 million in 3Q16.

Why the deviation?

The power plant segment recognized 46% of total revenues in 3Q17, a fall from 57% in 3Q16. For the residential segment, revenue recognized has risen to nearly 32% from 23% in 3Q16.

SunPower’s overall revenue fell 35% in 3Q17, primarily due to the drop in revenue recognized at the power plant segment. The fall in sales, especially in North America, of solar power systems and components to customers in the Commercial and Residential segments also contributed to the overall revenue decrease.

While comparing the financial data of upstream solar (TAN) companies like SPWR, First Solar (FSLR), NRG Energy (NRG), and Canadian Solar (CSIQ), we have to consider their revenue recognition model. The revenue recognition process may sometimes be nonlinear, which can cause reported sales to fluctuate hugely.

In the next part of this series, we’ll look at SunPower’s 3Q17 cost performance.